Microsoft is one of the world’s largest employers in tech, with its total headcount reflecting broader shifts in cloud, AI, and enterprise software. Its workforce strategy affects not only corporate efficiency but also tech labor trends globally. For example, Microsoft’s hiring in datacenter roles supports the expansion of Azure, and its restructuring impacts hiring norms in the competitive software sector. Let’s dive into the numbers behind who works at Microsoft as of today and why that matters.

How Many People Work at Microsoft?

- Microsoft employed 228,000 people globally in 2025, the same as in 2024.

- The headcount rose 3.17% from 2023 to 2024 (from 221,000 to 228,000).

- In 2025, Microsoft announced layoffs affecting about 4% of its workforce (≈ 9,000 employees).

- Datacenter roles at Microsoft grew 23.9% globally in 2024.

- In the U.S., datacenter roles grew 28.9% year over year.

- About 5.7% of global employees self‑identify as having a disability in Microsoft’s core business.

- Microsoft’s total workforce in 2025 remains unchanged from 2024 (no net growth in headcount).

Recent Developments

- In mid‑2025, Microsoft cut roughly 4% of its workforce, or ~9,000 roles, as part of a reorganization.

- Earlier in 2025, the company had already laid off over 6,000 employees (≈ 3%).

- The total layoffs in 2025 have accrued to around 15,300 employees (~ 6.7% of the workforce) when combining multiple rounds.

- Cuts have spanned many divisions, including sales, gaming, and management layers.

- Microsoft’s rationale cited the need to flatten organizational hierarchy and improve agility amid rising AI investment.

- Despite cuts, Microsoft continues to invest heavily in AI infrastructure, which may shift staffing toward new roles.

- Some analysts warn that future layoffs may continue as automation and AI reduce demand for redundant roles.

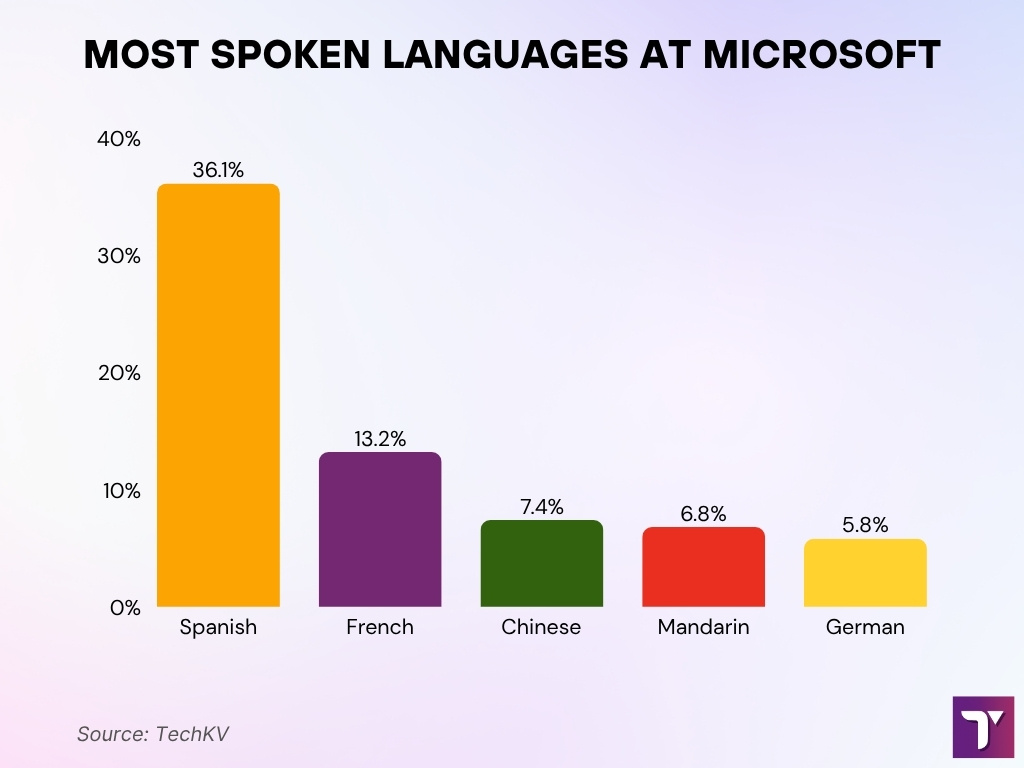

Top Languages Spoken at Microsoft

- Spanish is the most spoken language at Microsoft, with 36.1% of total employees.

- French ranks second at 13.2%, reflecting Microsoft’s wide European and African presence.

- Chinese represents 7.4%, driven by major Asian operations and partnerships.

- Mandarin follows at 6.8%, linked to Microsoft’s strong R&D base in China and other regions.

- German accounts for 5.8%, showing Microsoft’s Central European influence and workforce diversity.

Microsoft’s Current Team (Key People)

- Satya Nadella – Chairman and Chief Executive Officer. Nadella has led Microsoft since 2014, overseeing its transformation into a cloud-first, AI-integrated enterprise.

- Amy Hood – Executive Vice President and Chief Financial Officer. Hood plays a central role in financial strategy, M&A activity, and long-term investment planning.

- Judson Althoff – Executive Vice President and Chief Commercial Officer. Althoff manages worldwide commercial business and sales operations.

- Rajesh Jha – Executive Vice President, Experiences + Devices. He leads the teams behind Windows, Microsoft 365, and Teams.

- Scott Guthrie – Executive Vice President, Cloud + AI Group. Guthrie oversees Azure, AI platform strategy, and developer tools.

- Chris Young – Executive Vice President, Business Development, Strategy & Ventures. Young manages strategic partnerships and corporate investments.

- Brad Smith – Vice Chair and President. Smith leads Microsoft’s legal, policy, and regulatory affairs worldwide, playing a key role in global compliance.

- Kathleen Hogan – Executive Vice President and Chief Human Resources Officer. Hogan shapes Microsoft’s people strategy, culture development, and workforce equity.

- Charlie Bell – Executive Vice President, Microsoft Security. Bell oversees cybersecurity solutions and threat protection initiatives across all products.

- Phil Spencer – CEO, Microsoft Gaming. Spencer leads Xbox, Game Pass, and Microsoft’s broader gaming ecosystem, including the Activision Blizzard integration.

Microsoft Global Workforce Overview

- As of 2025, Microsoft reports 228,000 total employees globally.

- That headcount is unchanged from 2024, indicating zero net growth year over year.

- In 2023, Microsoft employed 221,000, so the 2024 increase added 7,000 roles.

- From 2021 to 2022, the company saw a jump from 181,000 to 221,000, a 22.1% increase.

- Microsoft’s workforce is spread globally, covering offices in 100+ countries.

- Datacenter employees are a growing segment within the workforce, with triple growth since 2020.

- The ratio of U.S. vs. non‑U.S. employees is roughly balanced in many tech firms, and one source notes ~120,000 in the U.S., ~108,000 outside the U.S.

- Microsoft also distinguishes “core business” roles vs subsidiary or acquired business roles in its reporting structure.

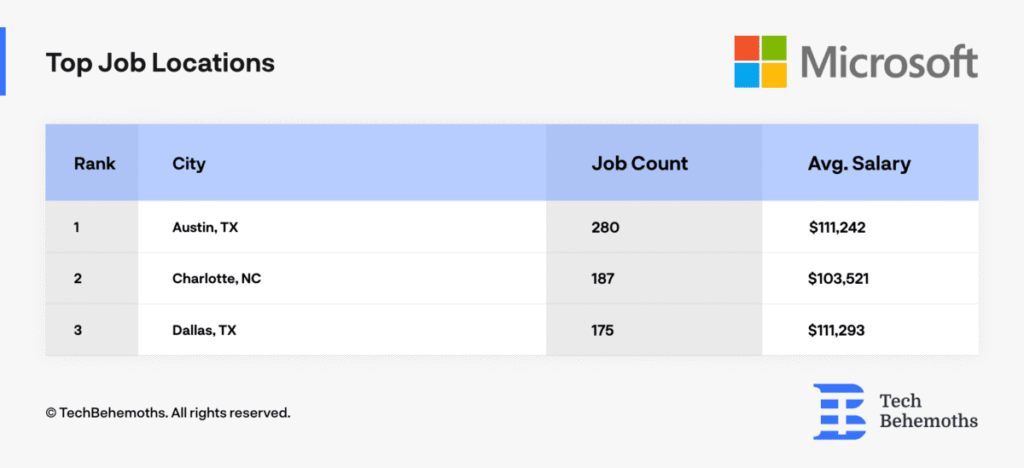

Top Microsoft Job Locations

- Austin, TX, leads with 280 jobs and an average salary of $111,242, underscoring its strong tech hub status.

- Charlotte, NC, ranks second with 187 roles and an average pay of $103,521, showing its growth as a tech operations center.

- Dallas, TX, places third with 175 positions and the highest average salary of $111,293, highlighting Texas’s premium for tech talent.

Employee Count by Year

- 2016: ~114,000 employees.

- 2017: ~124,000.

- 2018: ~131,000.

- 2019: ~144,000.

- 2020: ~163,000.

- 2021: ~181,000.

- 2022: ~221,000, a 22.1% jump.

- 2023: ~221,000, flat.

- 2024: ~228,000, a 3.17% increase.

- 2025: ~228,000, no net change.

Workforce Growth and Trends

- From 2021 to 2022, Microsoft added ~40,000 employees, ~ 22.1%.

- From 2023 to 2024, growth was ~7,000 employees, ~ 3.17%.

- After 2024, the workforce stabilized, with no reported net change in 2025.

- The frequency of layoffs in 2025 suggests more fluctuation than simple growth trends would show.

- A rising share of roles is concentrated in infrastructure, cloud engineering, and data centers.

- Microsoft’s shift to AI and cloud intensifies demand for specialized technical talent, which likely displaces older, generalized roles.

- Management reductions, fewer middle layers, are a recurring theme in recent restructuring.

- Observers estimate Microsoft’s headcount in late 2025 could dip between 220,000 and 230,000, depending on further cuts or hiring.

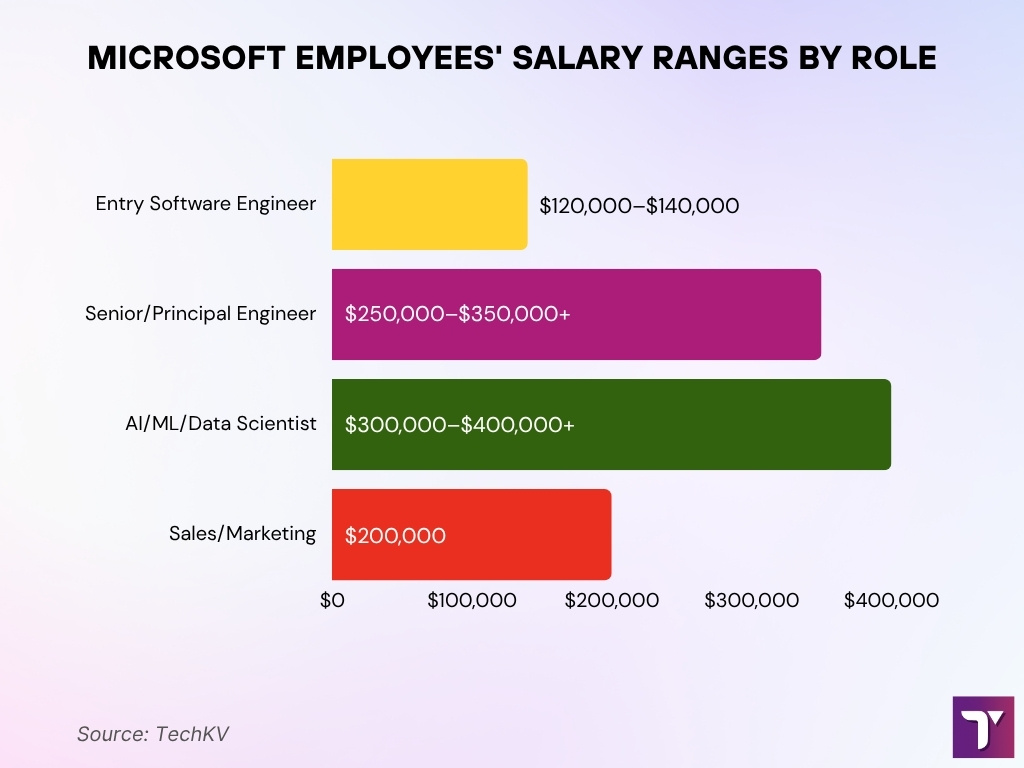

Microsoft Salary and Compensation Ranges

- Entry-level software engineers earn $120,000–$140,000 in base salary.

- Senior and principal engineers make $250,000–$350,000+ in total compensation.

- AI/ML specialists and data scientists can exceed $300,000–$400,000+ in top positions.

- Sales and marketing roles may surpass $200,000 annually with variable performance-based pay.

Research & Development Workforce

- In 2024, Microsoft reported about 81,000 employees in product R&D roles, up ~12.5% from the prior year.

- That figure represents roughly 35% of the total staff (81K of ~228K) allocated to technical innovation and development.

- The R&D workforce includes engineers, data scientists, AI researchers, and product managers across Azure, Office, Windows, GitHub, and other units.

- Microsoft Research itself is a smaller subset but highly visible, historically ~1,000+ researchers across locations.

- Investment in AI has pushed expansion in R&D roles, particularly in machine learning, model training, and infrastructure. Microsoft committed $80 billion to AI in 2025.

- Within acquired units, e.g., Activision or ZeniMax, some R&D staff have been absorbed into internal product teams.

- The year‑on‑year growth in R&D headcount exceeds that of many support units, reflecting a pivot toward innovation.

- Some redundancies in older product lines, e.g., legacy on‑prem software, may lead to reallocation rather than pure growth.

Sales and Marketing Employees

- Microsoft’s sales and marketing headcount has remained fairly stable at ~45,000 employees in recent years.

- That represents ~20% of the total workforce in a given year, 45K of ~228K.

- Any growth in this segment tends to focus on cloud sales, partner/channel management, and enterprise accounts.

- In the 2025 rounds of cuts, sales divisions were explicitly targeted in parts of the reductions.

- Some sales roles are being augmented or replaced by AI-assisted tooling, e.g., Copilot in selling, analytics.

- Marketing roles supporting AI product lines and developer outreach are expanding in certain geographic regions.

- Portions of legacy marketing, for older OS or device lines, have seen staff reductions or consolidation.

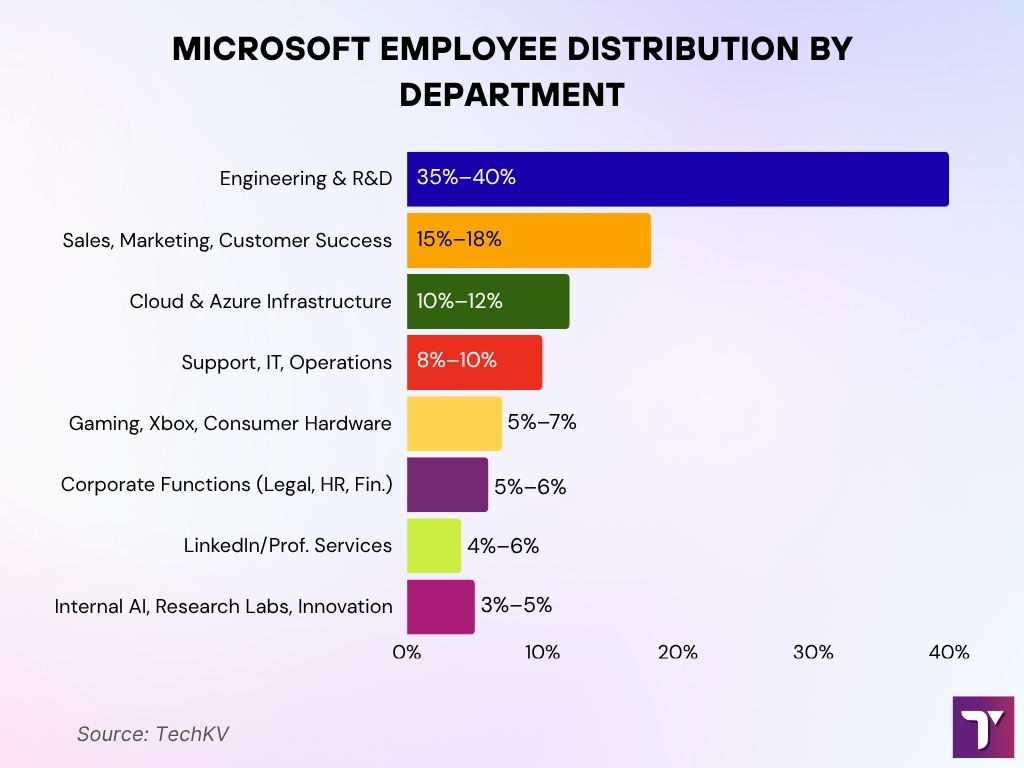

Microsoft Employee Distribution by Department

- Engineering & R&D account for 35–40% of Microsoft’s total workforce in 2025.

- Sales, Marketing & Customer Success represent 15–18% of global employees.

- Cloud & Azure infrastructure teams make up 10–12% of total staffing.

- Support, IT & Operations cover around 8–10% of the workforce.

- Gaming, Xbox & Consumer Hardware divisions employ 5–7% of staff.

- Corporate functions such as Legal, HR, Finance, and PR occupy 5–6%.

- LinkedIn & Professional Services units host 4–6% of employees.

- AI, Research Labs & Innovation groups represent 3–5%, often drawn from core engineering teams.

Operations and Support Staff

- Microsoft’s operations and support staff declined by approximately 3.37% in 2024-2025, dropping from 89,000 to 86,000 roles.

- The proportion of operations roles shrank to under 18% of the total workforce in 2025 as technical, engineering, and R&D roles expanded.

- Support function automation accelerated, with an estimated 28% of help desk tickets now resolved by AI-based tools, up from 16% in 2023.

- Annual attrition plus restructuring led to over 3,000 positions being cut in operations and support between January–September 2025.

- Microsoft’s data center operations staff now represents roughly 35% of its total support workforce, a 6% rise due to continued cloud growth.

- In 2025, over 40% of first-line support roles were either moved offshore or transitioned to managed service providers.

- Rollout of predictive analytics contributed to a 12% reduction in on-site maintenance visits across Microsoft’s North American facilities.

- The cost per support case dropped by 9% in fiscal year 2025 amid increased reliance on centralized, remote troubleshooting.

- Microsoft’s ongoing efficiency efforts mean its support functions now represent 11% lower payroll share compared to 2022.

- Experts expect support staff headcount to plateau or decline another 2–4% by the end of 2026 due to further process automation.

Administrative and Management Roles

- Microsoft’s administrative and management headcount increased modestly from ~15,000 to ~16,000 in recent years, despite cost pressures.

- In 2025, Microsoft cut approximately 6,000–9,000 management and admin roles, targeting middle management to “flatten” the organization.

- Restructuring actions in 2025 affected up to 4% of the global workforce, with many cuts focused on managerial layers and internal operations.

- Microsoft’s latest job reduction wave is its largest since 2023, with 3% of all staff affected, most from management or internal support teams.

- Administrative functions, including HR and facilities, are being centralized or scaled down in multiple geographies to reduce overhead.

- The span of control (direct reports per manager) has been increased, cutting redundant management layers across several acquired and legacy units.

- Over the past two years, hybrid leadership/technical roles have risen by 23%, reflecting a trend towards product-driven, technical management at Microsoft.

- After restructuring, payroll share spent on admin and management is now 8% lower than the 2022 figures.

- Internal data show leaner supervisory chains are correlated with a 10% reduction in process bottlenecks and better agility.

- Experts expect further consolidation of administrative roles in 2026, with estimates suggesting a 2–3% decline in headcount in that segment.

Recent Hiring and Layoff Trends

- In May 2025, Microsoft laid off 6,000+ employees, ~3% of the workforce, as part of restructuring.

- In July 2025, another ~9,000 layoffs, ~4%, were announced, bringing total cuts to ~4% of the workforce.

- The layoffs collectively represent some of Microsoft’s largest workforce reductions in years.

- According to headcount tracking data, Microsoft had 7,321 hires vs 7,992 departures, indicating a nearly balanced churn.

- Some reports estimate Microsoft has eliminated 20,000 to 22,000 jobs across 2022 to 2025.

- Cuts have spanned divisions, including sales, gaming, LinkedIn, management, and support.

- Despite layoffs, Microsoft continues to hire in priority areas like AI, cloud infrastructure, and data centers, balancing cuts elsewhere.

Notable Workforce Changes (Mergers and Acquisitions)

- Microsoft’s acquisition of Activision Blizzard, ≈ $68.7 billion in 2022, added more than 20,000 staff to its gaming and publishing wings.

- In early 2024, Microsoft Gaming cut 1,900 employees, ~8%, in a post‑integration reorganization.

- Several studios under Microsoft Gaming, Tango Gameworks, and Arkane Austin were closed or merged, with staff reassigned or laid off.

- In July 2025, some of the newer layoff rounds affected game studios, with ≈ 2,000 roles from gaming divisions included in the cuts.

- Acquisitions beyond gaming, e.g., cloud or enterprise software startups, sometimes absorb R&D or support staff into Microsoft’s global structure.

- Integration often leads to redundancies in overlap roles, e.g., duplicate HR, finance, and product teams.

- M&A drives shifts in where Microsoft allocates its workforce, growth in cloud, AI, gaming, and consolidation in legacy segments.

Impact of Artificial Intelligence on the Workforce

- Microsoft’s 2025 Work Trend Index finds that 68% of employees use AI tools weekly to automate repetitive office tasks.

- In 2025, 35% of Microsoft managers plan to hire AI trainers for workforce upskilling within the next 12–18 months.

- Surveys show 41% of staff report that generative AI directly helps reduce time on routine emails and documentation.

- The introduction of AI copilots has driven a 22% productivity gain in document preparation and summarization among office workers.

- Telemetry from Microsoft 365 reveals that knowledge workers face interruptions every 2 minutes from emails, chats, and meetings, even with AI assistants in use.

- 58% of administrative and support professionals expect AI will reshape their daily work, cutting repetitive tasks but not eliminating their roles.

- Data from developer surveys show a 27% mismatch between ideal and actual coding hours weekly, with automation expected to narrow this gap.

- Internal research indicates a 13% decrease in demand for basic administrative roles due to AI-driven process automation since 2023.

- The “infinite workday” effect, cited by 54% of respondents, is worsened by always-on AI tools, potentially blurring work-life boundaries.

- Broader studies show AI is augmenting rather than replacing: hybrid human–AI roles grew 19% faster than traditional single-skill jobs at Microsoft in 2025.

Diversity and Inclusion Statistics

- 31.6% of the core workforce are women, up 0.4 pts YoY.

- Women in technical roles: 27.2%, up 0.5 pts.

- U.S. Black/African American representation: 6.6%, slight decline.

- U.S. Hispanic/Latinx: 8.0%, up 0.1 pt.

- U.S. employees self‑reporting disability: 9.0%, up 0.2 pts.

- Military or Protected Veteran status in U.S.: 4.8%, no change.

- U.S. Indigenous representation: 0.6%, unchanged.

- In the broader Microsoft workforce, 53.9% identify as racial or ethnic communities, up 0.6 pts YoY.

- Senior leadership gains: Black & African American Partner+Executive level: 4.3%, up 0.5 pt.

- Hispanic & Latinx in executive roles: 4.6%, up 0.8 pt.

- However, retention is a concern; turnover among women and minority groups is rising, weakening inclusion gains.

- Microsoft tracks pay equity and reports maintaining no systemic pay gaps across gender, race, or ethnicity.

- Awareness metrics: by June 2024, 95.6% of employees reported some awareness of allyship programs, up from 65.0% in 2019.

Work‑Life Balance at Microsoft

- Microsoft telemetry shows uninterrupted focus time averages only 1.7 hours per day for employees on hybrid and remote schedules.

- 41% of surveyed staff report working “after hours” at least twice weekly due to increased asynchronous demands.

- In 2025, 81% of Microsoft employees reported no job changes in the past 12 months, showing high inertia or risk aversion.

- 52% of employees and 57% of leaders feel job security is uncertain, contributing to heightened stress and cautious work-life behaviors.

- Microsoft’s global Employee Signals scores reached 76 out of 100 in 2025, indicating strong but uneven “thriving” sentiment across locations and teams.

- 58% of employees say “the infinite workday” is a major concern, pointing to boundaries blurring between professional and personal time.

- Data suggests return-to-office mandates could elevate attrition among long-tenured, senior staff by up to 14%.

- New union drives in gaming and QA divisions are up 18% YoY, driven by concerns over work policy changes and employment security.

- Employees experience an average of 127 notifications per workday, fragmenting attention and adding to cognitive load.

- Despite these strains, 74% of global staff still report some degree of work-life satisfaction, but wide variations exist by department and geography.

Comparison with Other Tech Giants

- In 2025, Microsoft’s 4% workforce cut (~9,000 roles) parallels Meta’s 3.8% and Google’s 5.2% headcount reductions driven by AI investment and restructuring.

- Microsoft’s women’s representation stands at 31.6%, similar to Amazon (31.2%) but below Alphabet’s 33.5% target for the year.

- Amazon’s layoffs were concentrated in fulfillment and Alexa divisions, while Microsoft’s cuts focused on management and support consolidation.

- Compared to Google, Microsoft maintains a balanced workforce across enterprise/cloud and consumer, reflecting a dual focus in restructuring, while Google’s realignment highlights product and ad divisions.

- Meta’s diversity growth rate outpaces Microsoft’s, but both struggle with minority retention, each reporting turnover rates over 18% annually for underrepresented groups.

- AI-induced automation led to a 13–16% decline in certain nontechnical roles at Google and Meta, while Microsoft’s comparable figure is about 9%.

- Microsoft’s average tenure is 6.2 years, longer than Meta (4.8 years) but shorter than Amazon (7.1 years) as of 2025.

- Industrywide, AI-driven hybrid roles rose 20% at Microsoft and 24% at Google, showing a trend toward combining technical and managerial skillsets.

- Microsoft reported attrition among minority staff at 19%, echoing retention struggles seen at Amazon (20.5%) and Alphabet (18.7%) in 2025.

Frequently Asked Questions (FAQs)

Microsoft employed 228,000 people globally in 2025.

Microsoft laid off approximately 9,000 employees, about 4 % of its workforce.

About 53.9% of the workforce identifies as a racial or ethnic community.

Women make up 31.6% of Microsoft’s core workforce.

Conclusion

Microsoft’s workforce today remains at approximately 228,000 global employees, but the shape of that workforce is shifting dramatically. Recent layoffs, triggered by aggressive AI investments and structural realignment, suggest the company is making hard choices about where to focus talent.

Meanwhile, acquisitions have added capability but also complexity in assimilation. Efforts in diversity and inclusion continue to register gains, though retention of underrepresented groups is a clear challenge. Work‑life balance is under strain as the pace of interruptions and expectations intensifies. Against the backdrop of comparable moves by Meta, Amazon, and Google, Microsoft’s actions reflect both the opportunities and dangers of scaling AI in a massive organization. For anyone curious to track how these trends evolve, and what they signal about the future of work, this analysis is just the beginning.