Snapchat filters shape how users engage with each other, brands, and augmented reality. Today’s statistics reveal not just usage numbers but how filters accelerate creativity, e‑commerce, and digital identity. From daily AR engagement to sponsored campaigns, the data shows Snapchat filters are more than playful overlays, they’re a dynamic force in social media. Dive into the numbers that underscore a cultural shift in image, interaction, and innovation.

Editor’s Choice

- Snapchat boasted 460 million daily active users (DAUs) in early 2025, a year-over-year increase of about 9%.

- Monthly active users (MAUs) are nearing 900–932 million, with Q2 2025 reaching 932 million, up 7% year-over-year.

- Over 75% of users engage with AR lenses daily.

- Snapchat users interact with AR lenses 8 billion times per day, across 300 million users.

- 1 billion geofilters are used monthly, enabling local- and event-based creativity.

- Instagram and Facebook are retreating from AR, and Meta is discontinuing Spark AR by January 2025, which boosts Snapchat’s standing.

- In the U.S., 60% of the population is now frequent AR users, especially among people using social/communication apps.

Recent Developments

- Snapchat simplified AR creation by introducing tools that let users generate and publish lenses directly from mobile or the web.

- Meta’s shutdown of Spark AR by January 2025 will disable third-party AR filters on Instagram and Facebook, driving creators toward Snapchat’s Lens Studio.

- AR campaigns now outperform traditional digital ads by 200–300% in effectiveness.

- Snapchat continues to innovate Lens Studio, even as creator software complexity may require upskilling.

- AR adoption is rising; by 2025, nearly all social app users in the U.S. will engage with AR frequently.

- Filters increasingly link to e‑commerce, and virtual try-ons blur the line between play and purchase.

- Snapchat’s technological edge is widening even as competition deploys older or less supported effects.

Global Snapchat Filter Usage Statistics

- 75% of daily active users interact with AR lenses every day.

- Snapchat AR use hits 8 billion lens uses per day, with 300 million active users.

- In 2024, 113 million users engaged specifically with beauty AR lenses, and 100 million experienced AR shopping tools.

- 60% of U.S. consumers frequently use AR via social/communication apps.

- Snapchat outpaces Meta platforms, as Spark AR’s deprecation shifts AR activity to Snap.

Most Popular Snapchat Filters and Lenses

- Beauty AR lenses are especially popular, with 113 million users in 2024.

- AR shopping filters attract 100 million users globally.

- Creative, playful lenses like the iconic Dancing Hot Dog still highlight Snapchat’s cultural cache.

- Beauty filters contribute to the broader phenomenon of “Snapchat dysmorphia”, with over 200 million users playing with or viewing Lenses daily.

- Users engage with filters in Stories, Spotlight, Snap Map, and chat, though granular breakdowns aren’t always public.

Demographics of Snapchat Filter Users

- 90% of U.S. users aged 13–24 and 75% aged 13–34 are Snapchatters.

- More than 75% of users across Snapchat’s audience are under 35.

- In the U.S., roughly 30.6% of the population uses Snapchat, with 106 million users in early 2025.

- India leads Snapchat usage with over 210 million users, the U.S. is second with 105 million, and Pakistan is third with 39 million.

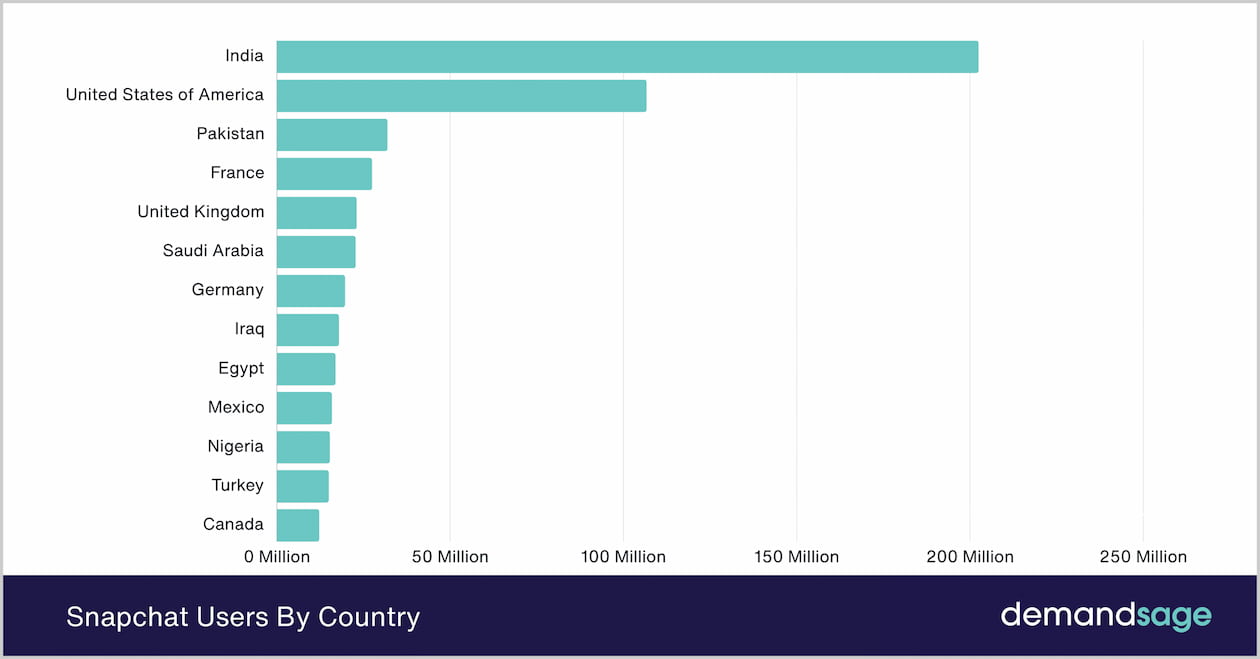

Snapchat Users by Country

- India leads globally with 204 million Snapchat users, making it the app’s largest market.

- The United States of America ranks second with 108 million users, about half of India’s user base.

- Pakistan holds the third spot, with approximately 26 million Snapchat users.

- France, one of the earliest adopters of Snapchat in Europe, records 24 million users.

- The United Kingdom follows closely with 22 million users, highlighting strong adoption in Western Europe.

- Saudi Arabia shows significant penetration with 21 million users, reflecting Snapchat’s popularity in the Middle East.

- Germany maintains a base of 20 million users, underscoring steady European engagement.

- Iraq contributes around 19 million Snapchat users, a notable figure for the region.

- Egypt is next with 18 million users, showing strong adoption in North Africa.

- Mexico has 17 million users, placing it among the leading Latin American markets.

- Nigeria accounts for 16 million users, showcasing rapid social media growth in Africa.

- Turkey reports 15 million Snapchat users, with steady year-over-year growth.

- Canada rounds out the list with 10 million users, reflecting its North American footprint.

Snapchat Filter Engagement by Region and Country

- India now hosts Snapchat’s largest user base, 210+ million, surpassing the U.S. (105 million).

- Snapchat usage in Saudi Arabia hits 87.7% penetration, while in Norway it’s 71.6%.

- Geofilters tally 1 billion uses per month, offering massive local engagement.

- Snap Map sees 350+ million monthly users, strengthening region-based engagement.

Branded and Sponsored Snapchat Filters Statistics

- Geofilters are a marketing staple; 1 billion uses per month offer hyper-local reach.

- Snapchat’s advertising reach grew by 11.8% year-over-year, reaching 557.1 million users as of January 2025.

- Snapchat projects ad revenue growth toward $8.34 billion by 2027.

- Over 1 million creators are monetizing Snapchat content, including branded filters.

- AR campaigns beat traditional ads by 200–300% in effectiveness.

Augmented Reality (AR) Filter Adoption Rates

- By 2025, 75% of the global population is expected to use AR technology, with social platforms like Snapchat at the forefront.

- Daily AR sessions on Snapchat surpass traditional ad effectiveness by 200–300%.

- Snapchat-based AR experiences now reach over 200 million daily active users.

- In 2025, 56% of Gen Z early jobbers (ages 18–27) purchased something they saw on Snapchat.

- Among parents of minors, 70% made purchases influenced by Snapchat, the highest conversion across segments.

- Prominent mobile AR market data shows revenue rising from $11.9 billion in 2024 to $13.8 billion in 2025, signaling growing user reach and investment.

- Snapchat now serves as a primary AR entry point, especially after Meta’s waning support for third-party AR tools.

- Over 100 million users currently engage with AR shopping tools through Snapchat.

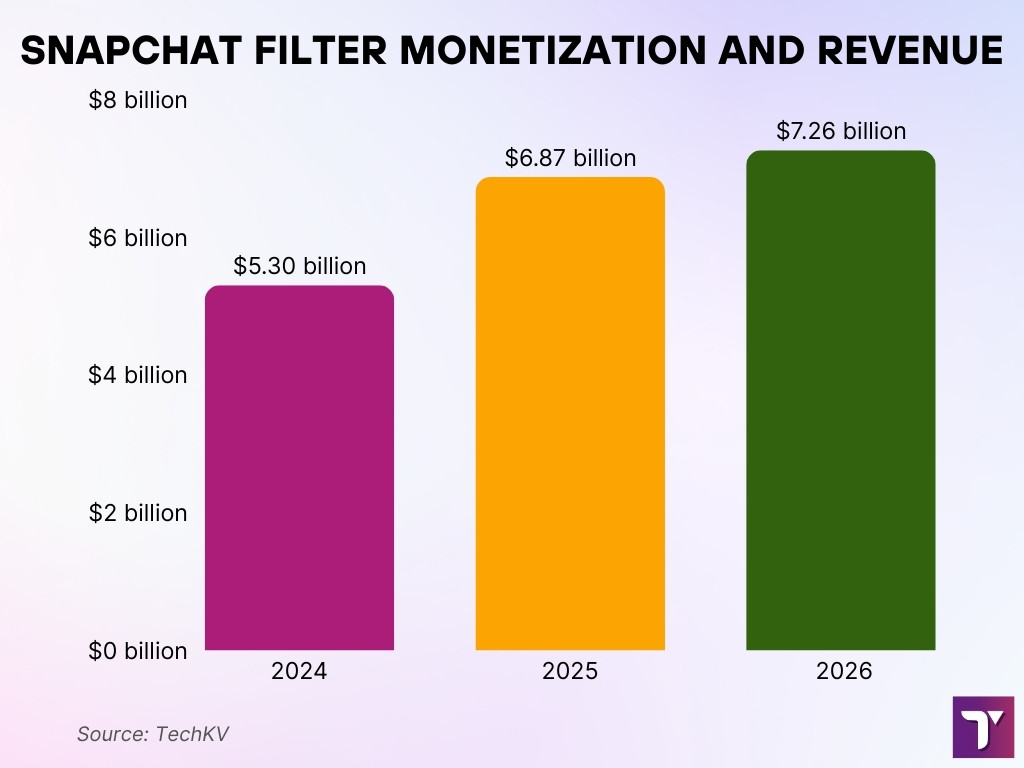

Snapchat Filter Monetization and Revenue

- Snap’s ad revenue is projected to climb from $6.87 billion in 2025 to $7.26 billion in 2026.

- Snapchat recorded 15.2% revenue growth in 2024, reaching $5.3 billion, despite net losses of $697 million.

- Snap posted 9% year-over-year revenue growth in Q2 2025, totaling $1.35 billion, though hampered by an ad tech glitch.

- Geofilters deliver substantial ROI; over 1 billion uses per month generate localized monetization.

- Snapchat ads directly drive $10 billion in sales, illustrating strong return on ad investments.

- Snap+ subscription surpassed 12 million users in Q3, more than doubling from the prior year.

- AR campaigns consistently outperform traditional ads by 200–300%, improving marketing ROI.

- High sound-on engagement, 64% of Snap ads are watched with audio enabled, drives full creative exposure.

Beauty and Fashion Filter Usage

- Snapchat beauty filters contribute to the rise of “Snapchat dysmorphia”, a trend where users seek plastic surgery based on filtered appearance.

- More than 200 million users play with or view Lenses daily, often with beauty-enhancing effects.

- Among young women, 60% felt upset when their real appearance didn’t match their filtered images.

- By age 13, 80% of girls regularly alter their look using social media filters.

- Filters often prioritize Eurocentric ideals, lighter eyes, and a smaller nose, raising concerns over beauty norms.

- Studies link filter use to body dissatisfaction, anxiety, and reduced self-esteem.

- Brands increasingly integrate beauty and fashion filters with virtual try-ons for online shopping experiences.

Snapchat Filter Impact on App Downloads and Growth

- Snapchat has 900 million MAUs and 460 million DAUs as of early 2025, a 9% year-over-year DAU increase.

- The app is opened 30+ times daily, and users spend over 30 minutes per day engaging with content, especially filters.

- Chat drives 60% of all interactions, with filters playing a key role in visual communication.

- Retention rate for new users after 30 days is 69%, demonstrating long-term stickiness.

- 14 billion videoviews daily and 5+ billion Snaps created per day reflect high filter-enabled activity.

- Spotlight continues growing, with over 350 million daily views, and many include filters.

- Snap Map has over 300 million monthly users, often interacting with location-based filters.

Gender Distribution of Filter Users

- As of February 2025, Snapchat’s global gender split is 48.4% male, 50.7% female, and 0.9% unspecified.

- This nearly even gender balance supports inclusive filter design and targeting strategies.

- Gender distribution remains consistent across regions, reflecting stable user composition.

- Filter engagement is similarly balanced, with no major gender skew reported in usage patterns.

- Ad recall is highest among Gen Z viewers, 55% recall after only 0–2 seconds of ad exposure, across people.

- Among parents, Snapchat’s purchase influence and ad sharing rates are high regardless of user gender.

- Filter-driven shopping and fashion content appeals equally across the gender divide, enhancing relevance.

Filter Usage in Stories and Spotlight Videos

- 66% of users watch their friends’ Stories every day, while 52% view creator content regularly.

- About 30% of users engage with Spotlight regularly.

- Spotlight videos reached 550 million MAUs in Q1 2025 and accounted for over 40% of time spent on the app.

- Snapchat receives 350 million daily Spotlight views, many incorporating AR filters.

- 78% of users engage with the camera frequently, where filters are accessed.

- There are 14 billion video views daily, often enabled by filter-enhanced Snaps.

- Over 5 billion Snaps are created each day, most featuring filters.

Snapchat Geofilter Usage Statistics

- Over 1 billion geofilters are used per month, highlighting local relevance and creativity.

- Geofilters remain a key tool for hyper-local marketing and brand interaction.

- Snap Map enjoys over 300 million monthly users, many of whom engage with location-based filters.

- The prevalence of geofilters aligns with Snapchat’s regional engagement strategy.

User Engagement Metrics for Filters

- Globally, 75% of daily active users engage with AR features every day.

- Users spend an average of 30 minutes per day on Snapchat, and filters are a large part of that time.

- The average user opens the app 30+ times daily, driven largely by filter interaction.

- Snapchat ads (often filter-enabled) drive $10 billion in direct sales.

- AR shopping tools are used by over 100 million users.

- Snap+ subscription has surpassed 12 million users, fueling extended engagement.

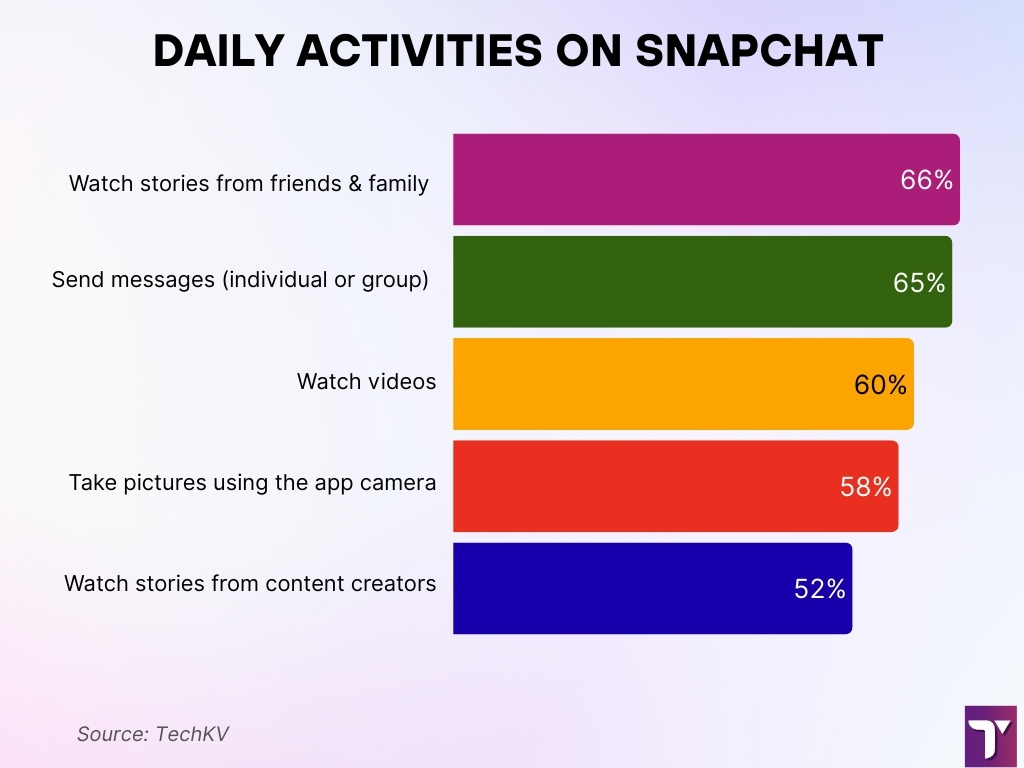

Top 5 Daily Activities on Snapchat

- 66% of users watch stories from friends and family every day, making it the most common activity on Snapchat.

- 65% of users send messages, either to an individual or group, highlighting Snapchat’s strength as a messaging platform.

- 60% of users watch videos daily, reflecting the platform’s growing role in video content consumption.

- 58% of users take pictures using the app’s built-in camera, showing Snapchat’s continued focus on quick, visual communication.

- 52% of users watch stories from content creators, underlining Snapchat’s role in creator-driven engagement.

Cross‑Platform Filter Sharing Trends

- Snapchat’s Lens Studio now allows the creation of filters compatible with Instagram, extending reach.

- Cross‑platform creativity thrives, and users share Snapchat filters on TikTok and Instagram.

- The Camera Kit SDK brings Snapchat’s AR tools into partner apps, expanding usage beyond Snap.

- Snap simplifies AR creation via mobile/web tools with AI and Bitmoji integration, promoting wider sharing.

- These integrations drive user-generated content and filter virality across the social ecosystem.

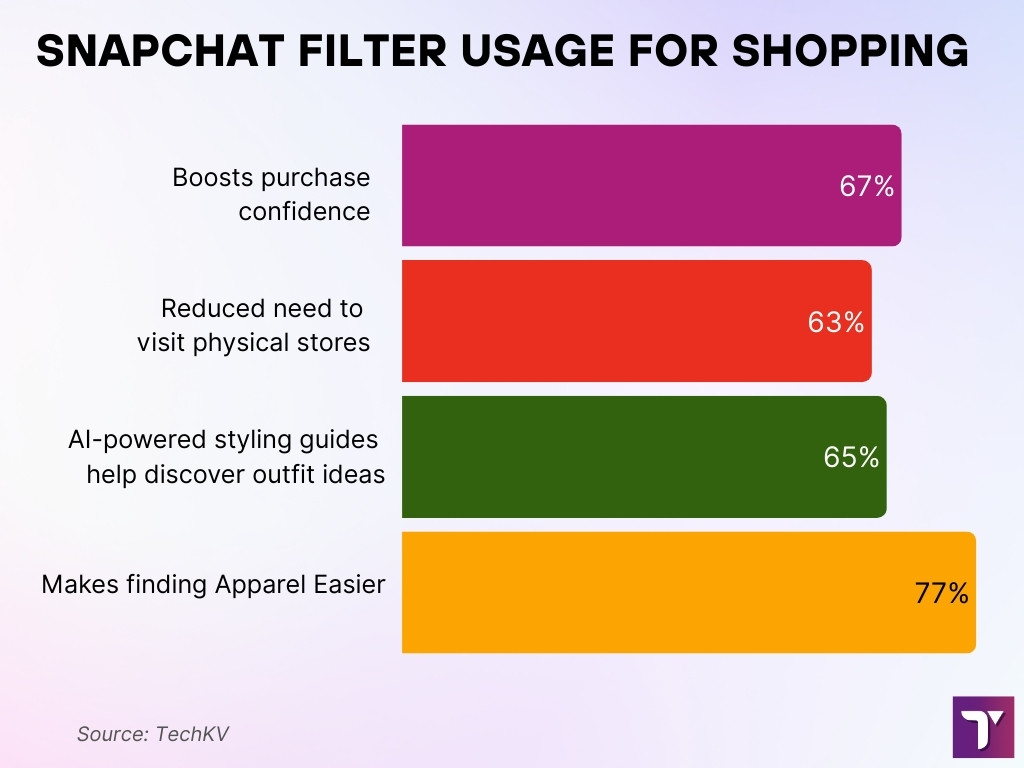

Snapchat Filter Usage for Shopping and Virtual Try‑Ons

- 67% of users say AR virtual try-ons help them make more confident purchase decisions.

- 63% agree that AR lenses reduce their need to visit a physical store.

- 65% find that AI-powered styling guides on Snapchat help them discover new outfit ideas, 2.1× higher than non‑users.

- 77% believe visual search via AR makes finding apparel easier.

- AR shopping on Snapchat boosts sales conversions by 31% and reduces return rates by 22–40%.

- Virtual try-ons deeply reduce returns and increase customer confidence.

- Brands like Perfect Corp partner with Snapchat for shoppable AR beauty experiences.

Future Predictions for Snapchat Filters

- AI-driven filters like “Shapeshifter” are expected to go viral in 2025.

- Seasonal campaigns remain powerful, and timed launches align with consumer search spikes.

- Cross‑platform AR sharing will grow, increasing reach across TikTok and Instagram.

- Mobile and web tools will democratize AR creation, and anyone can become a creator.

- Virtual try-ons will continue expanding, with broader application in jewelry, fashion, and accessories.

- Rising ROI, AR experiences are increasingly seen as essential, not optional.

Conclusion

Snapchat’s filters are more than visual play; they’re evolving into powerful tools that drive engagement, support commerce, and shape social media creativity. With millions of daily users embracing AR-enhanced storytelling, geolocated filters, and virtual try-ons, Snapchat continues to lead the digital lens revolution. As cross-platform sharing expands and AI-powered creation tools democratize content, we can expect even deeper integration of filters into how we communicate, shop, and express identity. Stay tuned for the next wave of immersive experiences that blur the lines between digital and real.