The truth is that iPhones and Android smartphones dominate the market. With each trying to take over the market and retain more customers, a battle is going on. But have you wondered how different Android and iPhone users are? Well, if you have, you will get some insights from the iPhone vs Android user statistics from 2025, which we have covered below.

Apple vs Android Market Share

- As of 2025, the global market share of iPhone stands at 29.27%, showing modest growth across iOS devices.

- Android continues to dominate with a 69.48% global market share in 2025, leading the smartphone ecosystem.

- Back in 2014, iOS held 23.95%, indicating a gradual gain of nearly 5.3 percentage points over the past decade.

- In 2014, Android’s share was 53.65%, meaning it gained over 15.8 percentage points in just ten years.

- In 2009, iOS had a 34.01% market share while Android lagged at just 2.41%, highlighting its explosive growth.

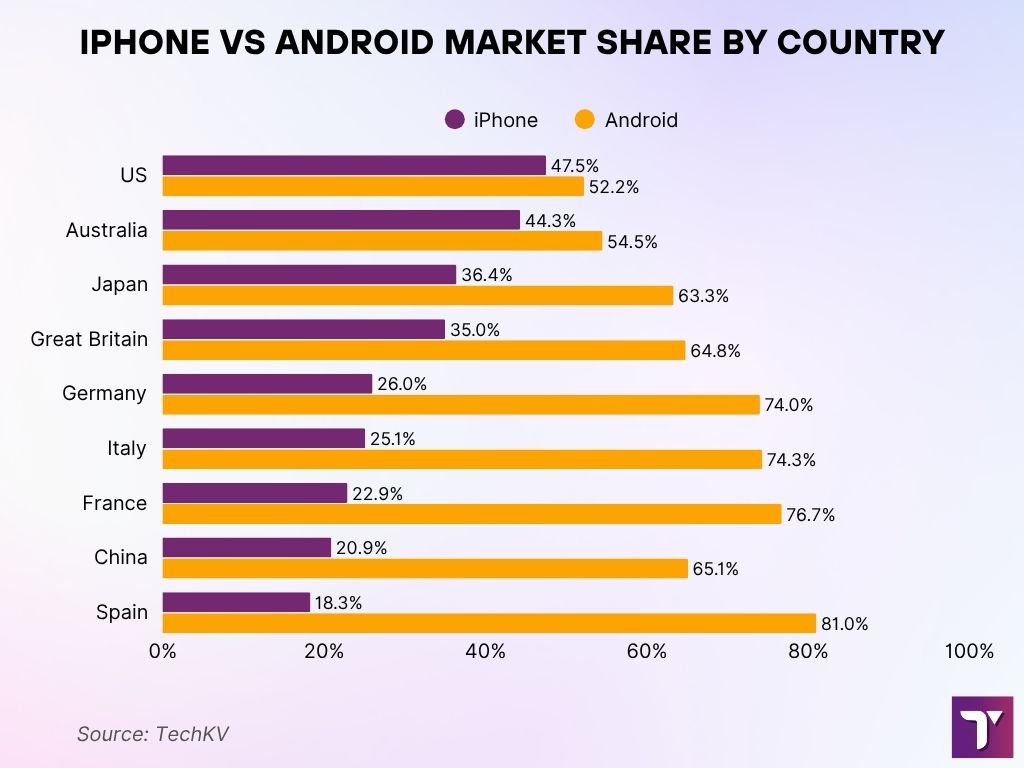

iPhone vs Android Market Share by Country

- In the US, iPhone (47.5%) trails slightly behind Android (52.2%) in smartphone market share.

- Australia shows a similar trend with iPhone at 44.3% and Android leading at 54.5%.

- In Japan, iPhone holds 36.4% of the market while Android dominates with 63.3%.

- Great Britain reports 35% iPhone usage compared to 64.8% for Android.

- Germany has only 26% iPhone users, while Android commands 74% of the market.

- In Italy, iPhone accounts for 25.1%, whereas Android leads with 74.3%.

- France reflects a similar pattern: 22.9% iPhone versus 76.7% Android.

- In China, iPhone usage is 20.9%, while Android holds 65.1% of the market.

- Spain shows the widest gap, with only 18.3% iPhone users and a dominant 81% Android share.

Age Demographics

- In 2025, 33% of Gen Z users globally prefer iPhone, while Android still leads the segment.

- Among Millennials (born 1981–1996), 37% favor iPhones, reflecting increasing brand loyalty over time.

- Within Gen X, Android holds 61% market share versus iPhone, showing continued preference for functionality.

- Baby Boomers favor Android at 56%, with iPhone trailing in older age groups.

- In the United States, 60% of users aged 18–34 prefer iPhones, while Android has 39% in the same bracket.

- For Americans aged 35–54, Android leads with 54%, with iPhone adoption at 46%.

- In the 55+ US group, Android holds 52%, while iPhone follows at 48%, maintaining a narrow gap.

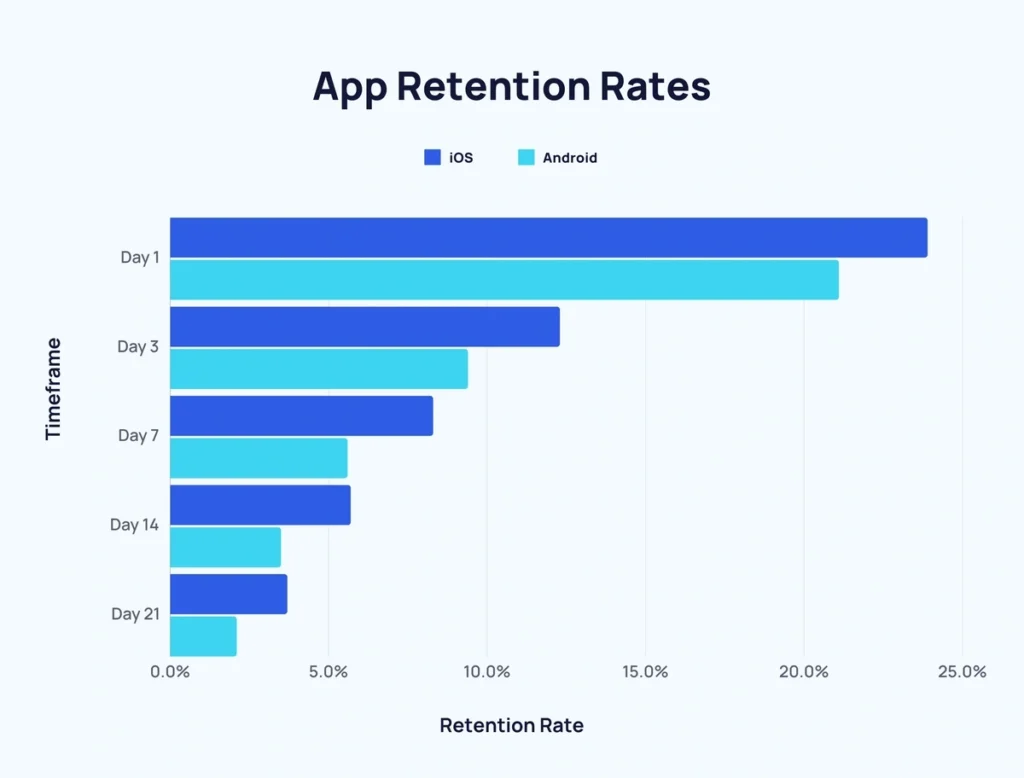

iOS vs Android App Retention Rates

- On Day 1, iOS apps retain 23.9% of users compared to 21.1% on Android.

- By Day 3, retention drops to 12.3% for iOS and 9.4% for Android.

- On Day 7, only 8.3% of iOS users remain, versus 5.6% for Android.

- At Day 14, retention declines to 5.7% on iOS and just 3.5% on Android.

- By Day 21, only 3.7% of iOS users stick around, while Android falls to 2.1%.

Gender Demographics

- In 2025, 33% of female smartphone users globally prefer iPhones, while Android leads with 55% among women.

- Customization, pricing, and variety remain key reasons why Android attracts most female users.

- Among male users, Android holds 61% of the market, while iPhones account for 29% in 2025.

- Android’s versatility and control continue to drive higher male adoption rates globally.

- Male users spend more time on advanced Android features like system-level customization and open-source apps.

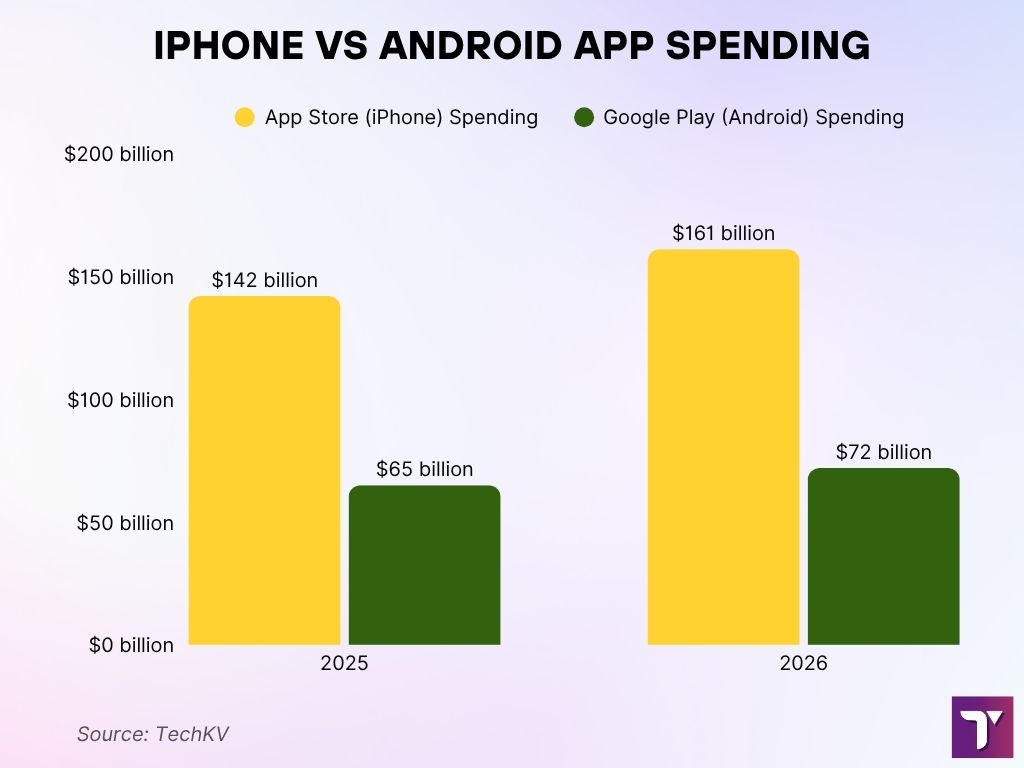

iPhone vs Android App Spending

- In 2025, App Store spending hit $142 billion, nearly 2.2x more than Google Play’s $65 billion.

- By 2026, iPhone users spent $161 billion on apps, while Android users spent $72 billion.

- App Store revenue grew by $19 billion from 2025 to 2026, showing stronger user monetization.

- Google Play spending rose by $7 billion, but it still lags far behind iOS in total app revenue.

- Apple’s App Store consistently outpaces Google Play in both spending growth and overall market value.

Income and Education Levels

- In 2025, the average income of an iPhone user is around $55,980, reflecting a high-income demographic.

- Android users average $38,600 per year, aligning with broader affordability and accessibility.

- iPhone users are more likely to hold a college or graduate degree, especially in urban settings.

- Android users span all education levels, from high school dropouts to advanced professionals, showing demographic diversity.

- iPhones dominate in urban areas, while Android remains strong in both urban and rural markets globally.

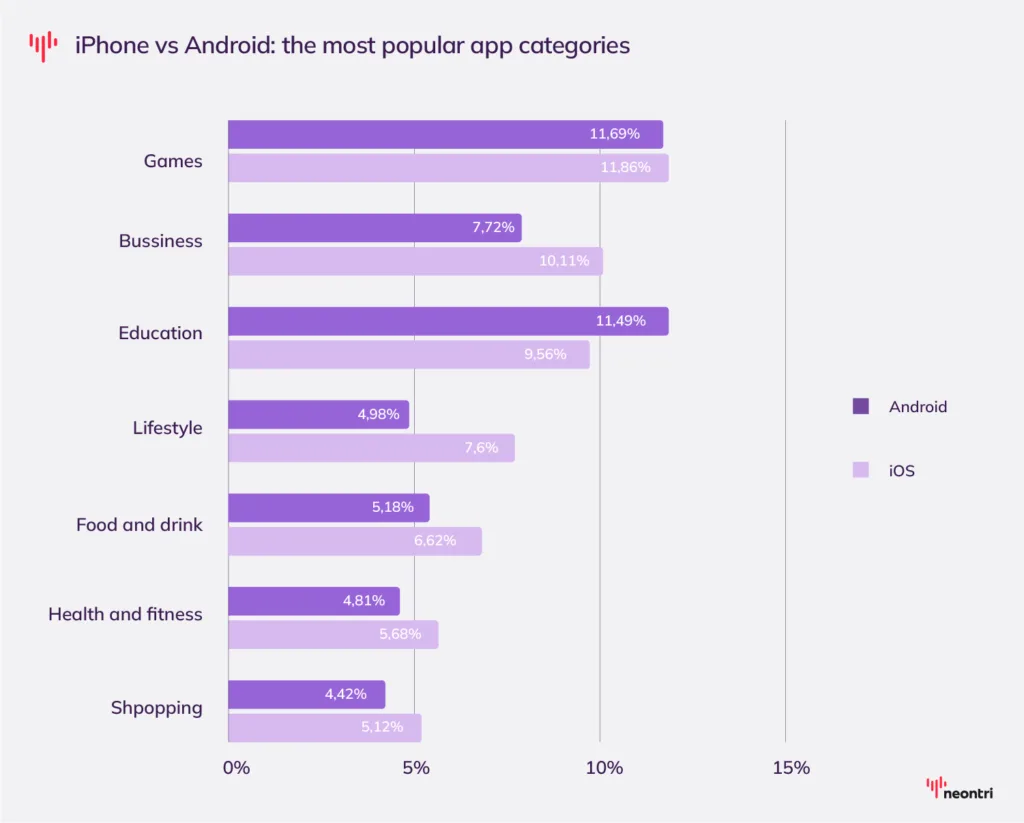

Most Popular App Categories: iPhone vs Android

- Games dominate on both platforms with 11.86% on iOS and 11.69% on Android.

- Business apps are more popular on iOS (10.11%) than on Android (7.72%).

- Education apps rank high on Android (11.49%), beating iOS at 9.56%.

- Lifestyle apps account for 7.6% on iOS, ahead of Android’s 4.98% share.

- Food and drink apps are used more on iOS (6.62%) than on Android (5.18%).

- Health and fitness apps have a 5.68% share on iOS and 4.81% on Android.

- Shopping apps make up 5.12% on iOS vs 4.42% on Android.

Device Usage Patterns

- In 2025, the average iPhone user spends 5 hours and 18 minutes of screen time per day, mostly on messaging and selfies.

- Android users average 3 hours and 55 minutes of daily screen time, slightly increased from previous years.

- iPhone users spend more time on camera and social apps, contributing to higher daily usage.

- Android users prioritize functionality, using more time on utilities, web browsing, and messaging apps over visuals.

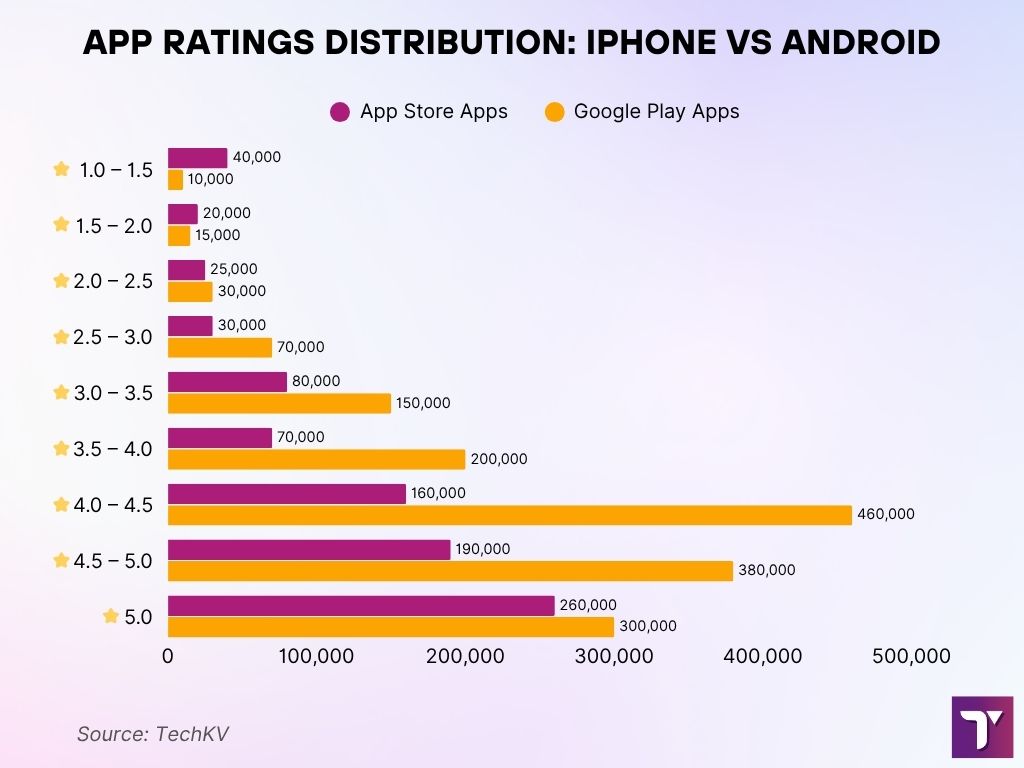

App Ratings Distribution: iPhone vs Android

- iOS has the highest number of 5.0-rated apps with 260,000, slightly ahead of Android’s 300,000.

- The most common rating for Google Play is 4.0–4.5, with a massive 460,000 apps, compared to 160,000 on iOS.

- 4.5–5.0 apps are also strong on both platforms: 190,000 for iOS vs 380,000 for Android.

- In the 3.0–4.0 range, Android dominates with 350,000+ apps, while iOS has 150,000.

- Low-rated apps (1.0–2.5) are more prevalent on iOS, especially in the 1.0–1.5 band, with 40,000 apps, while Android only has 10,000.

- Android offers more apps across nearly all rating bands except 5.0, where iOS briefly takes the lead.

Conclusion

As you can see, a surface-level comparison between iPhone and Android user statistics in 2025 reveals more insights about the mobile user experience in general. Our coverage also includes region-specific stats that are useful for advanced researchers. You might want to count on these details and further research if you want to invest in one of these markets or make an informed decision.

1 Comment

Great stats! It’s fun to see how iPhone and Android users compare. I like both for different reasons—iPhones for how well EVERYTHING works together and Androids for the customization.