AI chips power the latest advances in machine learning, generative models, and edge computing. They are not just hardware; they drive revenue, shape technological leadership, and push industry boundaries. For example, data centers use AI chips to accelerate training of large language models, while automotive firms rely on them for driver-assistance systems. The statistics below will help you understand how big, how fast, and how impactful the AI chip market has become.

Editor’s Choice

- The global AI chip market size is estimated to be around $83.80 billion in 2025.

- The same market is expected to grow to $459.00 billion by 2032 (CAGR ~ 27.5%).

- In 2024, semiconductor industry sales globally reached $627 billion, with forecasts for $697 billion in 2025.

- Generative AI chip demand was under‑predicted. Deloitte estimated the gen‑AI chip market would far exceed earlier predictions, expecting more than $150 billion worth in 2025.

- In 2024, U.S.-based private AI investment was $109.1 billion, nearly 12× China’s $9.3 billion.

- The global AI chip market value in 2025 is projected by some analysts to be $166.9 billion, with growth rising to $311.6 billion in later years.

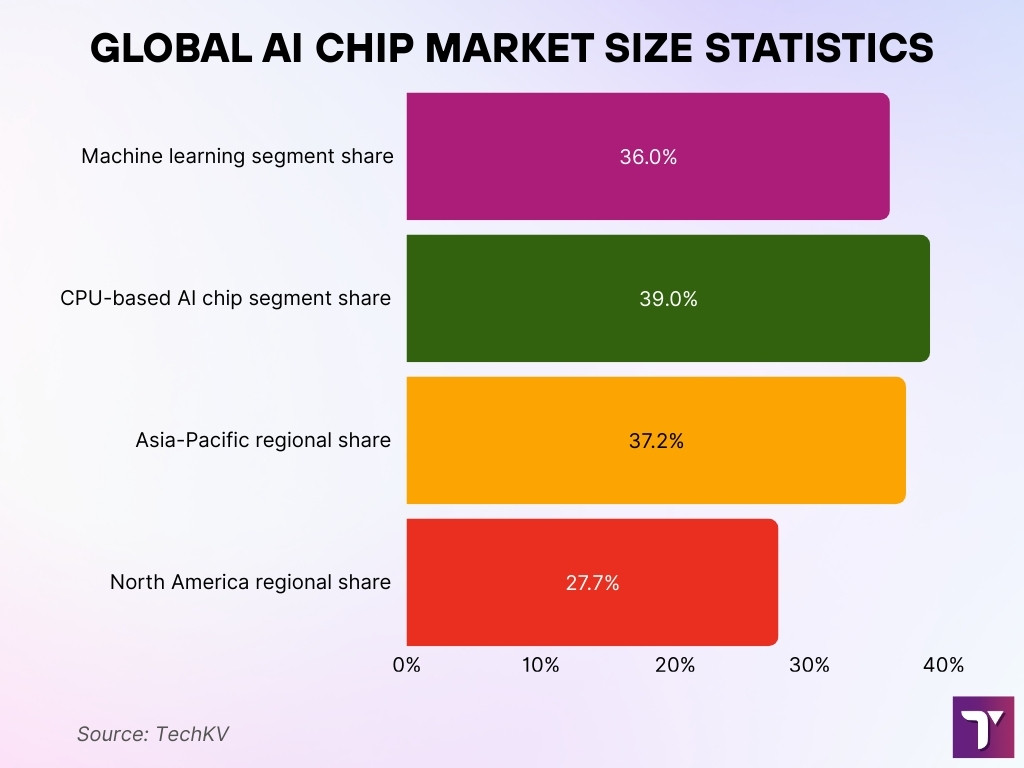

- The machine learning segment leads among applications of AI chips, with about 36% share of the market in 2025.

Recent Developments

- Arm launched its Lumex chip designs in 2025, built for on‑device AI processing on smartphones, wearables, etc., using advanced 3‑nanometer process nodes.

- NVIDIA’s new RTX6000D, designed for the Chinese market under export restrictions, is reportedly underperforming compared to other options.

- ASML invested $1.5 billion in European AI startup Mistral AI to speed up future chip design work.

- Broadcom is being priced at ~$420/share by analysts, citing its dominance in ASICs, a segment growing from under $11 billion in 2024 to over $80 billion by 2028.

- The EU’s InvestAI initiative commits €200 billion to AI investments, including building AI data centres or “gigafactories” with large GPU capacities.

- Lenovo predicts that all PCs will become AI‑enabled within 5 years, notably via NPUs.

- Morningstar warns that despite the surge, the chip industry may still experience its traditional boom‑bust cycle, especially given macroeconomic pressures and softening demand outside core AI workloads.

Global AI Chip Market Size Statistics

- The estimated value of the global AI chips market in 2025 is $83.80 billion.

- Forecasted size by 2032, $459.00 billion, assuming ~ 27.5% CAGR from 2025‑2032.

- Another report projects the global AI chip market to move from $123.16 billion in 2024 to $166.9 billion in 2025.

- Semiconductor industry sales overall are expected to reach $697 billion in 2025, boosted by AI‑related demand.

- AI accelerator chips’ addressable market estimated by AMD’s CEO to reach $500 billion by 2028.

- The machine learning segment leads with approximately 36% of market share in AI chips in 2025.

- CPU‑based AI chip segment is projected to hold about 39% of the market in 2025.

- Asia‑Pacific is expected to lead in regional share, around 37.2% of the global AI chips market in 2025.

- North America is predicted to have ~ 27.7% share in 2025.

AI Chip Market Growth Trends

- The compound annual growth rate (CAGR) for the global AI chips market is approximately 27.5% from 2025 to 2032.

- The overall semiconductor industry revenue growth from 2024 to 2025 is expected at ~ 7.5%, pushing sales from $627B to about $697B.

- Growth in generative AI has accelerated investment and chip demand beyond earlier forecasts.

- ASIC designs for AI accelerators are growing rapidly versus more general‑purpose chips, especially in data centers and inference workloads.

- Edge AI chip adoption is increasing, with integration into IoT, wearables, and mobile devices pushing demand.

- Regions like Asia‑Pacific are growing faster, supported by manufacturing capacity, government support, and local demand.

- Custom chips for inference workloads are capturing more market share relative to GPUs for certain applications.

AI Chip Revenue Statistics

- Global AI chip market revenue in 2025 is estimated at $83.80 billion.

- Markets & Markets projects revenue of $166.9 billion in 2025 for AI chipsets globally.

- In 2024, NVIDIA’s AI‑related revenue was already large, which analysts believe will more than double by 2030.

- Revenue from data centers and cloud AI infrastructure represents a growing share of AI chip sales.

- Edge revenue (smartphones, wearables, etc.) is projected at billions in 2025, e.g., edge AI chips forecasted to reach around $13.5 billion in 2025.

- Automotive AI chip revenue is projected to exceed $6.3 billion in 2025.

Regional Market Statistics

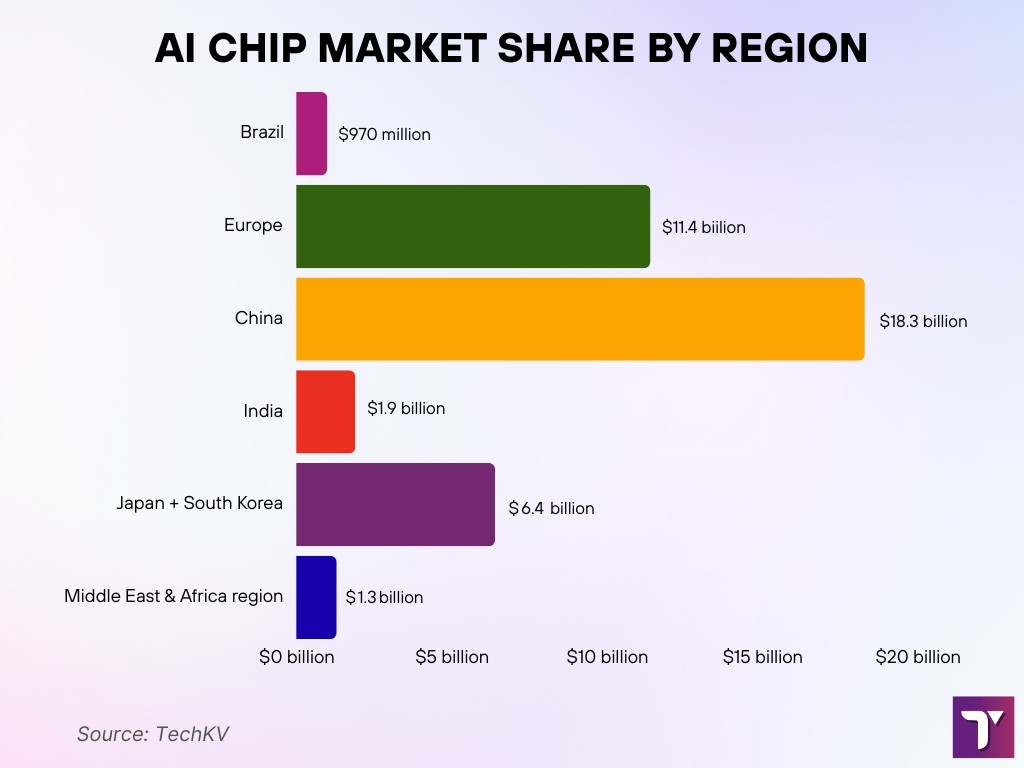

- The Asia‑Pacific region is projected to hold ~ 37.2% of the global AI chips market in 2025.

- North America’s share is about 27.7% in 2025.

- Europe’s AI chip revenue is forecasted to be roughly $11.4 billion in 2025.

- China’s AI chip market is expected to reach $18.3 billion in 2025.

- India is an emerging market, projected at approximately $1.9 billion in 2025.

- Japan + South Korea combined are forecasted to contribute about $6.4 billion in 2025.

- Latin America’s leading market, Brazil, is expected to bring in nearly $970 million in AI chip sales in 2025.

- The Middle East & Africa region is estimated to generate $1.3 billion in AI chip demand.

Leading AI Chip Manufacturers

- NVIDIA holds approximately 86% share of the AI GPU segment in 2025.

- Taiwan Semiconductor Manufacturing Company (TSMC) remains the leading foundry.

- Samsung Foundry had ~ $21 billion in foundry revenue in 2023 and is expanding capacity.

- GlobalFoundries, SMIC, and others operate at a smaller scale compared to TSMC and Samsung.

- AMD is growing its AI chip division fast.

- Intel continues investing in AI training and inference solutions.

- Google, Amazon, Apple, Meta, and Qualcomm are active in custom AI chip design.

AI Chip Types and Specifications

- GPUs dominate in 2025, expected to hold ~ 46.5% of the AI chip market.

- TPUs hold ~ 13.1% of the market share in 2025.

- Custom ASICs for edge inference are projected to bring in $7.8 billion in revenue in 2025.

- FPGAs contribute ~ $3.2 billion in 2025.

- Hybrid chips with NPUs forecast to grow 22.4% YoY in 2025.

- Chips optimized for Transformer architectures represent ~ 20% of AI hardware in 2025.

- The neuromorphic chips market is forecast to reach around $480 million in 2025.

- Open‑source architectures like RISC‑V are projected to exceed $1.1 billion in 2025.

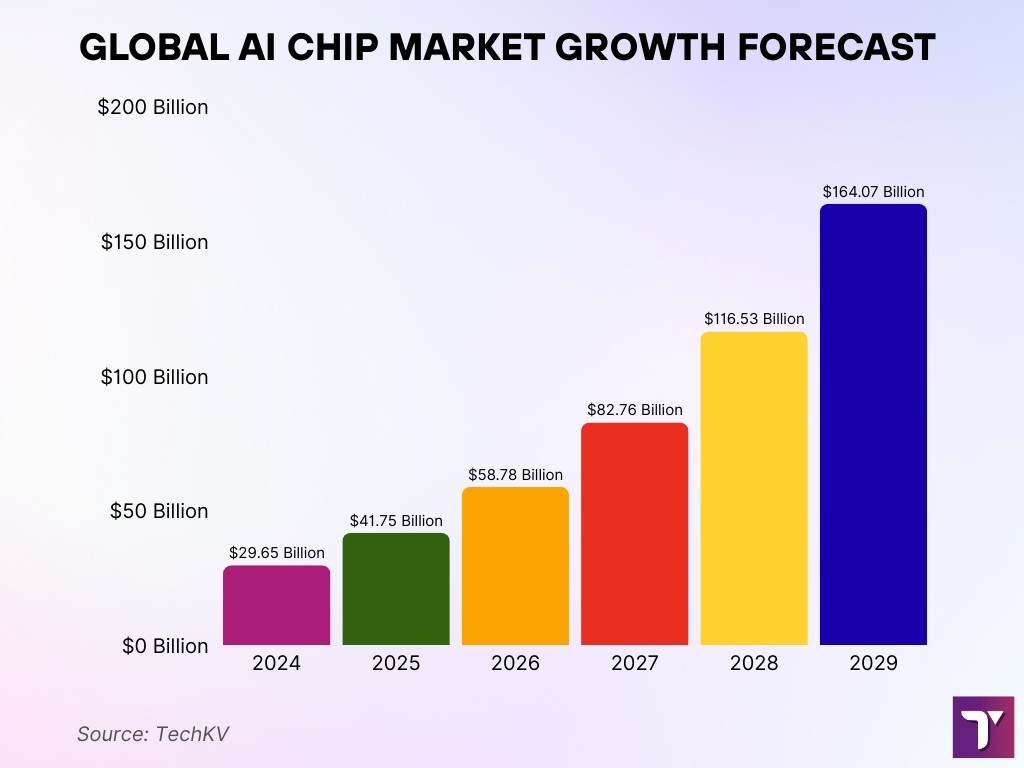

Global AI Chip Market Growth Forecast

- The AI chip market size in 2024 is estimated at $29.65 billion.

- By 2025, the market is projected to reach $41.75 billion, showing strong momentum.

- The market will continue its rapid expansion, climbing to $58.78 billion in 2026.

- By 2027, the market size is expected to surpass $82.76 billion, almost tripling its 2024 value.

- Growth accelerates further with a forecast of $116.53 billion in 2028.

- By 2029, the global AI chip market is projected to achieve a staggering $164.07 billion.

- The sector is expanding at a compound annual growth rate (CAGR) of 40.8%, making it one of the fastest-growing technology markets globally.

- This surge reflects the increasing adoption of AI technologies across industries such as healthcare, automotive, finance, and consumer electronics.

Industry Applications of AI Chips

- Data centers consume over 52% of all AI chips in 2025.

- Edge applications are expected to represent about $14.1 billion in deployments.

- Automotive AI chips forecasted to surpass $6.3 billion.

- Healthcare is projected to generate $2.2 billion in chip demand.

- Smart home AI chips are expected to produce $1.4 billion in 2025.

- Robotics and automation systems will use AI chips worth over $2.6 billion.

- Retail analytics accounts for ~ $850 million in AI hardware.

- Drones and unmanned vehicles will contribute $1.1 billion in hardware revenue.

AI Chip Adoption Rates by Sector

- ~ 78% of organizations globally reported using AI in 2025.

- 72% of companies use AI in at least one business area.

- Only ~ 13% of organizations have no AI plans.

- Top industries include IT, finance, services, and manufacturing.

- Generative AI use jumped from ~55% in 2023 to ~75% in 2024.

- Companies expect a ~ 38% boost in profitability from AI by 2025.

- Adoption is growing at ~ 20% per year in many sectors.

- SMEs are catching up to large enterprises in AI adoption.

Cost and Pricing Statistics

- NVIDIA H100 GPU purchase price starts around $25,000; full systems can cost $400,000+.

- Hourly rental of H100 GPU averaged $2.37 in May 2025.

- Advanced node mask costs can reach $297 million for 7 nm.

- Infrastructure costs (power, cooling, etc.) often double TCO.

- Cloud GPU rental ranges from $2 to $12+ per hour.

- Inference cost per query is declining due to improved chips.

- Levelized AI chip cost models are emerging.

- Smaller companies face pricing pressure from rental dependency.

Investment Statistics in AI Chips

- AI chip startups raised $7.6 billion in VC during late 2024.

- Generative AI private investment reached $33.9 billion in 2024.

- U.S. private AI investment totaled $109.1 billion in 2024.

- Positron raised $23.5 million in a seed round in 2025.

- AI infrastructure companies raised $400 million+ in Q1 2025.

- Axelera AI received €61.6 million for the Titania chip project.

- Global AI startup funding exceeded $100 billion in 2025.

- Google invested $75 billion in AI infrastructure in 2025.

AI Chip Innovations and Developments

- Arm’s new Lumex CPU designs, built on the 3‑nanometer process, deliver 5× better AI performance and 3× efficiency over previous models.

- SK hynix has developed HBM4 memory modules with a 2,048‑bit interface and 10 GT/s speeds for next‑gen AI accelerators.

- Nvidia’s upcoming Blackwell Ultra GB300 chip offers 20 petaflops FP‑performance and is paired with 288 GB of HBM3e memory.

- The Rubin architecture (by Nvidia) is expected to deliver 50 petaflops of FP4 throughput when launched, significantly up from the Blackwell baseline.

- Google’s Trillium (6th‑gen TPU) chip exhibits a 4.7× improvement in AI performance over its TPU v5e predecessor.

- WaferLLM, a wafer‑scale LLM inference system, shows 200× better accelerator utilization than state‑of‑the‑art GPU systems, and is 22× more energy efficient for GEMV operations.

- Japan’s ABCI 3.0 supercomputer, operational from early 2025, offers 6.22 exaflops (half precision) and 3.0 exaflops (single precision), a 7‑13× performance improvement over ABCI 2.0.

- Lisa Su, AMD’s CEO, predicts that global demand for AI chips could exceed $500 billion within the next few years, driven by large‑scale AI acceleration needs..

Challenges and Limitations In The AI Chip Market

- Global electricity demand from data centers is projected to more than double by 2030 to around 945 TWh, largely driven by AI‑optimized workloads.

- As of 2023, U.S. data centers consumed about 176 TWh, or 4.4% of total U.S. electricity usage; this may rise to 6.7‑12% by 2028.

- AI systems could possibly account for up to 49% of total data center power consumption by the end of 2025 (excluding crypto mining).

- There are 5,426 data centers in the U.S. by March 2025, consuming around 17 gigawatts (GW) in 2022; in 2018, there were ~ 1,000 centers using ~ 11 GW.

- A state‑of‑the‑art 3nm chip fab costs are estimated between $15‑20 billion, making entry very difficult except for the largest firms.

- Semiconductor supply capacity is expected to grow at a 7% CAGR through 2028, but over half of new capacity will be added in China, with only a few nations leading advanced node production.

- Delivery times for key semiconductor equipment have stretched to 18‑24 months, creating bottlenecks in advanced node manufacturing.

- Limited production capacity for 3nm and 5nm nodes, with firms like TSMC and Samsung facing delays in ramping up those production lines.

Environmental Impact Statistics

- Data centers consumed an estimated 415 Terawatt‑hours (TWh) of electricity in 2024, about 1.5% of global power demand.

- Global electricity demand from data centers is projected to more than double by 2030 to around 945 TWh.

- AI‑optimized data centers’ electricity demand is expected to quadruple by 2030.

- In the U.S., data centers accounted for over 4% of total electricity consumption in 2023.

- Those U.S. data centers emitted more than 105 million tons of CO₂e in 2023, about 2.18% of national greenhouse gas emissions; their carbon intensity exceeded the U.S. average by 48%.

- Indirect water consumption tied to U.S. data centers’ electricity use reached nearly 800 billion liters in 2023.

- Emission factor: U.S. data centers averaged about 0.34 kg CO₂e per kWh from electricity usage; water consumption was about 4.52 liters per kWh.

- Data centers are expected to make up about 2% of global electricity consumption in 2025 (roughly 536 TWh), rising toward 1,000‑1,300 TWh by 2030, depending on efficiency improvements.

- Annual water use by AI data centers is projected to hit 1,068 billion liters by 2028, representing around an 11‑fold increase from current levels.

Government Policies and Regulations

- In 2025, all 50 U.S. states, plus Puerto Rico, the Virgin Islands, and Washington, D.C., introduced legislation related to AI; 38 states enacted around 100 measures addressing AI issues.

- The U.S. federal government released America’s AI Action Plan in July 2025, which includes 90+ policy recommendations spanning innovation, infrastructure, diplomacy, security, and AI export strategy.

- Executive Order 14320, signed July 25, 2025, promotes the export of the American AI technology stack to strengthen U.S. global leadership in AI hardware, software, and standards.

- U.S. tightened export controls: the government limits access to advanced AI chips for countries like China, Russia, Iran, and North Korea, while granting broader access to allied nations.

- In 2024, U.S.-based semiconductor firms exported about $57.5 billion worth of AI chips; current export rules seek to impose licensing requirements and caps on shipments to certain countries.

- China issued a mandate requiring its domestic data centers to source over 50% of their chips from local manufacturers, aiming for reduced reliance on foreign AI hardware.

- The EU’s AI Act (Regulation (EU) 2024/1689) entered into force on August 1, 2024; from August 2, 2025, rules for general-purpose AI models and high‑risk obligations begin to apply.

AI Chip Competitive Landscape

- NVIDIA holds about 94% of the discrete GPU (add‑in‑board) market in Q2 2025, with AMD at just 6%.

- In Q1 2025, NVIDIA secured approximately 92% of the add‑in‑board GPU shipments globally.

- NVIDIA controls around 80% of the AI accelerator market as of mid‑2025.

- In the AI GPU segment for 2025, NVIDIA’s share is estimated at 86%.

- Intel, Google (via TPUs), Apple, Qualcomm, and custom ASIC/edge players still hold relatively small slices of market share-collectively making up < 20% of the AI‑accelerator/AI‑chip adoption outside NVIDIA’s dominance.

- Analysts expect NVIDIA to maintain ~90% share of the AI GPU / training/inference infrastructure market through 2030.

- Broadcom is estimated to command about 75% of the ASIC market for specific AI workloads, which is projected to grow from under $11 billion in 2024 to over $80 billion by 2028.

Frequently Asked Questions (FAQs)

The global AI chip market is projected to be $ 166.9 billion in 2025.

In 2025, GPUs are expected to hold about 46.5% of the AI chip market, while TPUs are projected to have around 13.1%.

The Asia‑Pacific region is estimated to lead with about 37.2% share of the global AI chips market in 2025.

The AI hardware market is expected to grow at a CAGR of 18% between 2025 and 2034.

Custom ASICs designed for edge inference are projected to generate about $7.8 billion in revenue in 2025.

Conclusion

AI chips are at a crossroads, innovation is rapid, markets are expanding steeply, and performance is improving, but so are the environmental, cost, and regulatory pressures. Key gains in efficiency, both in hardware (e.g., energy per operation) and model design, are lowering the cost and impact of AI inference. However, challenges like escalating power consumption, materials sourcing, and carbon emissions remain significant. Thanks for exploring these AI chip statistics. May you find insight and direction for strategy, investment, or research in this evolving field.