Blockchain technology has evolved far beyond cryptocurrency, shaping the backbone of digital trust and decentralized systems across industries. From supply chain traceability in logistics to secure identity verification in finance and healthcare, blockchain’s utility is reshaping how businesses handle data, automation, and compliance.

In this article, we’ll explore the most recent and impactful blockchain statistics from around the globe, giving you a data-driven look at where the industry stands and where it’s heading.

Editor’s Choice

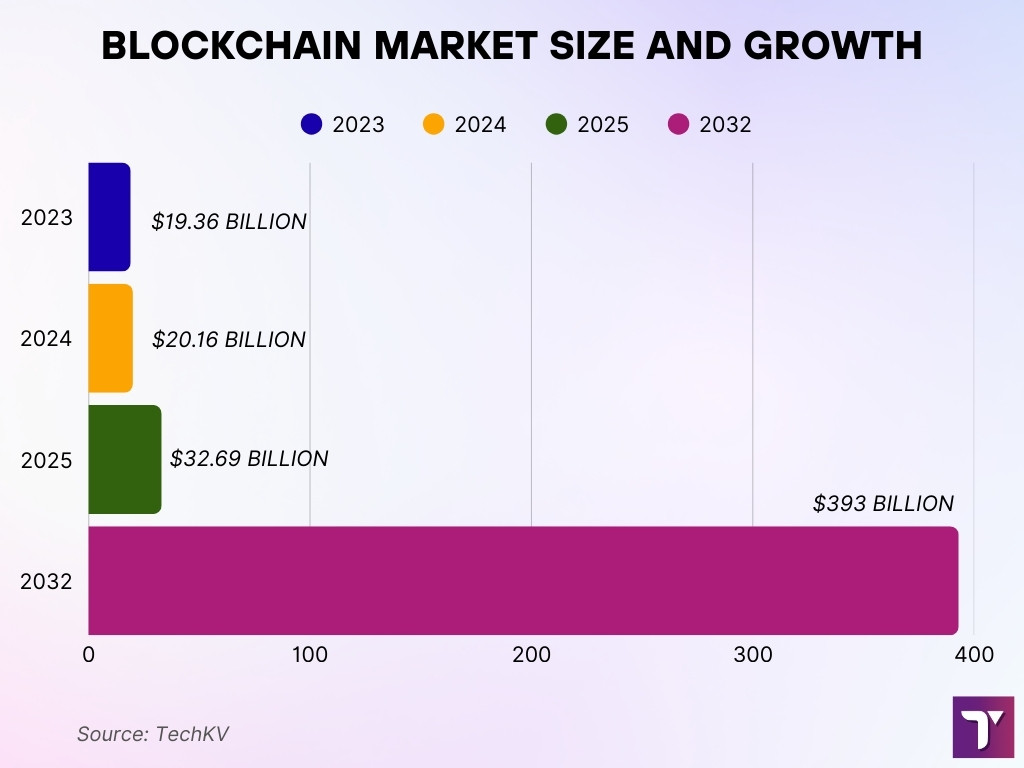

- The global blockchain technology market is expected to grow from $20.16 billion in 2024 to $31.18 billion in 2025, with a projected CAGR of 43.6% by 2032.

- Another forecast puts the 2025 blockchain market size at $32.69 billion, up from $19.36 billion in 2023.

- Worldwide spending on blockchain solutions surged to $19 billion in 2024, up notably from prior years.

- Over 560 million people globally own cryptocurrencies as of 2024.

- Crypto adoption in the U.S. rose from 20% ownership in 2024 to 22% in 2025.

- Among non-owners in the U.S., 23% said the Strategic Bitcoin Reserve boosted their confidence in crypto value.

- DeFi lending protocol Aave holds a dominant 45% market share with TVL of $25.41 billion as of May 2025.

Recent Developments

- U.S. crypto ownership expanded from 20% to 22% year over year through 2025.

- 23% of U.S. non-owners felt more confident in crypto thanks to the launch of a Strategic Bitcoin Reserve.

- Corporate interest rose sharply, and CFOs expect blockchain or digital currency use within 2 years, with only 1% ruling it out entirely.

- Security breaches hit over $2.17 billion stolen in crypto services by mid-2025, exceeding all 2024 losses.

- Institutional treasuries held 966,304 ETH (~$3.5 billion) in July 2025, vs under 116,000 ETH at the end of 2024.

- Crypto payroll use tripled recently, with USDC the most-used token for salaries.

- A historically large $1.5 billion hack of ByBit is the biggest single crypto security loss.

Overview of Blockchain Technology

- Blockchain is a decentralized digital ledger that enables secure, transparent, and tamper-proof transactions across industries.

- The platform segment, critical to decentralized apps, was valued at over $11 billion in 2024.

- North America held a 37-43% share of the global blockchain market in 2024, with the U.S. leading.

- Blockchain is increasingly used in finance, healthcare, supply chain, smart contracts, payments, and identity.

- Public blockchain tech, such as Ethereum and Bitcoin, is growing fastest, with CAGRs over 50% from 2025-2034.

- Platform services, such as protocols and APIs, dominated offerings, followed by growth in blockchain consulting and implementation services.

Blockchain Market Size and Growth

- Market size, $20.16 billion in 2024, rising to $31.18 billion by 2025.

- Alternative forecast, $32.69 billion in 2025, up sharply from $19.36 billion in 2023.

- Adoption boosting market spending, $19 billion was spent on blockchain solutions in 2024.

- Some forecasts predict a long-term market of $1.43 trillion by 2030, up from a few tens of billions now.

- Another report suggests skyrocketing growth to over $393 billion by 2032, reflecting a 43.6% CAGR 2025-32.

- North America remained the leading region, with a strong double-digit CAGR ahead.

- Public blockchain tech, especially platforms, is expected to maintain dominance, contributing significantly to growth.

Cryptocurrency Market Statistics

- Globally, over 560 million people own crypto as of 2024.

- In the U.S., adoption grew from 20% (2024) to 22% (2025).

- 39% of U.S. crypto owners now own crypto ETFs, up from 37% in 2024.

- Around 50% of Gen Z and Millennials globally report crypto ownership at some point.

- Aave’s DeFi protocol held 45% market share with $25.41 billion TVL in May 2025.

- Crypto fraud soared, $2.17 billion stolen by mid-2025, surpassing all of 2024.

- Institutional crypto holdings, 966,000 ETH ($3.5B) held mid-2025 vs <116,000 ETH end-2024.

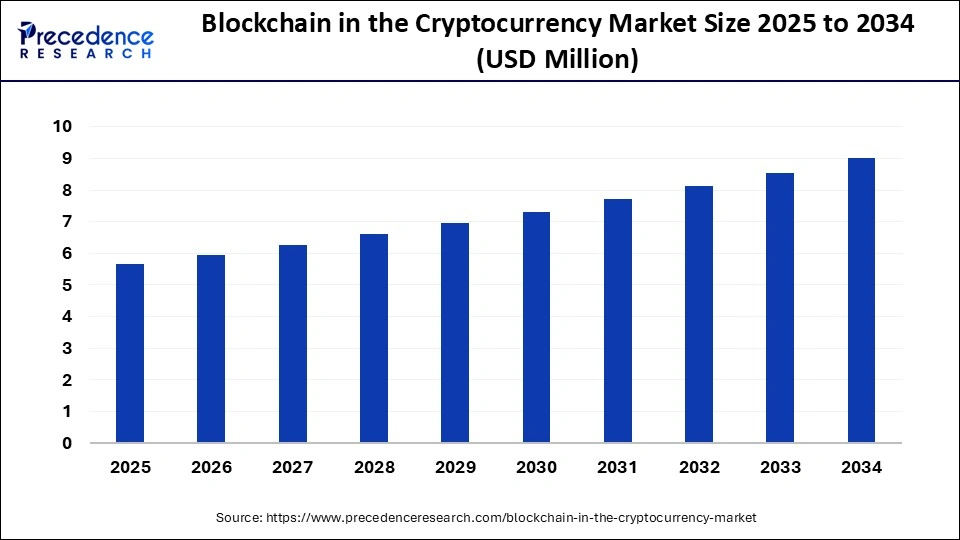

Blockchain in the Cryptocurrency Market Size

- The blockchain in the cryptocurrency market is projected to grow steadily from 2025 to 2034, reflecting rising adoption and investment.

- In 2025, the market size is estimated at $6.5 million.

- By 2026, it is expected to increase to $7.0 million, marking a healthy year-over-year rise.

- In 2027, the market is projected to reach $7.3 million, signaling growing enterprise use cases.

- 2028 anticipates a further climb to $7.6 million, backed by global digitization trends.

- $8.0 million is forecasted for 2029, demonstrating sustained growth momentum.

- In 2030, the market is set to reach $8.3 million, supported by fintech innovation and DeFi applications.

- 2031 shows continued progress, with market size climbing to $8.6 million.

- By 2032, estimates put the market at $8.9 million, showing expanding enterprise blockchain integration.

- In 2033, the size is expected to hit $9.2 million, indicating broad sector maturity.

- By 2034, the blockchain in the cryptocurrency market is forecast to achieve $9.6 million, almost a 48% growth over 2025 levels.

Adoption and Usage Statistics

- Nearly 90% of businesses surveyed report deploying blockchain technology in some form.

- Global spending on blockchain hit $19 billion in 2024, a marked rise.

- Over 560 million cryptocurrency users worldwide, reflecting rising consumer adoption.

- U.S. crypto ownership increased to 22% in 2025, up from 20% in 2024.

- Crypto ETF ownership among U.S. crypto holders rose to 39%.

- DeFi usage is strong, Aave leads with 45% share and $25.41 billion TVL as of May 2025.

- Executive confidence elevated, 23% non-owners gained confidence from the Strategic Bitcoin Reserve launch.

Transactions and Network Activity

- In June 2025, Solana led blockchain networks with 2.98 billion transactions, followed by BNB Chain at 446 million and Base at 296 million.

- Ethereum trailed with 41.8 million transactions, notable compared to Solana’s scale.

- Active addresses dipped from approximately 508,000 in February to 446,000 in April, reflecting a temporary lull.

- Cross-chain token transfers exceeded $28 billion and 11.3 million transactions across five protocols in late 2024.

- Sidechain interoperability use is set to grow by 43% in 2025, boosting throughput and scalability.

- Multi-chain NFTs surged 133% since 2022, signaling growing demand for cross-network digital art.

- Decentralized identifiers (DIDs) account for 6% of emerging blockchain identity solutions in 2025.

Mining and Hashrate Statistics

- Bitcoin miners gained $11.2 billion in 2025, a 7.1% increase from the prior year.

- Next-gen ASICs boosted hash rate performance by 35% over older models.

- The global Bitcoin hash rate peaked at 943 EH/s on May 31, 2025, a new all-time high.

- As of August 10, 2025, the average network hashrate was 868.63 M TH/s, up 49.4% year-over-year.

- The all-time highest Bitcoin hashrate reached 1,222.41 EH/s on June 30, 2025.

- Riot Platforms (RIOT) operated at 29.8 EH/s and aims to scale to 41 EH/s by the end of 2025.

- Core Scientific (CORZ) at 18.1 EH/s and Iris Energy (IREN) powered entirely by renewables, are aggressive growth players.

Wallets and Addresses

- Over 85 million people worldwide use blockchain wallets, up from just 10 million in 2016.

- Blockchain users hit 560 million in 2025, about 3.9% of the global population.

- Usage by region, Asia (160 million), Europe (38 million), North America (28 million), Africa, and South America together account for over 56 million.

- The disparity between services and active users suggests opportunities to bridge gaps in accessibility.

- Wallets enable access to DeFi, NFTs, DApps, and cross-chain trading.

- Growth remains driven by improved mobile and UX design in wallet applications.

Supply Chain and Industry Applications

- Major industries, finance, supply chain, healthcare, gaming, and government, are increasingly adopting blockchain, with accelerating use in 2025.

- Corporations pilot supply chain tracking via blockchain for transparency and traceability.

- In trade and securities, platforms like Tradeweb are integrating blockchain to streamline settlement and collateral management.

- Finance firms and consortia are developing blockchain infrastructures like the Canton Network for inter-institutional transactions and tokenization of assets.

- These platforms support regulated tokenization of gilts, eurobonds, and gold, enhancing asset liquidity.

- Blockchain is enabling secure interoperability across partners in logistics and manufacturing.

Finance and Banking

- Blockchain fuels DeFi services, enabling lending, borrowing, trading, and yield generation outside traditional banking.

- Tradeweb’s foray into tokenization is aimed at improving efficiency in collateral and settlement in finance.

- Institutions increasingly test public permissioned networks like Canton, the result of a major banking consortium.

- Blockchain-backed tokenization is gaining traction for real-world assets like bonds and commodities.

- Banks are exploring digital ledger tech to reduce costs and enhance security across desk-level transactions.

- Growth in digital fiat-backed stablecoins positions blockchain as a core part of the cross-border finance momentum.

Security and Performance Metrics

- Crypto services suffered $2.17 billion in losses in 2025, already surpassing 2024, with the ByBit hack accounting for the largest single loss ($1.5 billion).

- Transactions networks monitor performance via active address tracking, which dipped in early 2025.

- Cross-chain tools like XChainDataGen enable deep analysis of interoperability performance and security.

- Researchers identify bidirectional causality between fees and activity, especially in stablecoin and DEX usage, impacting fee markets.

- Hasrate growth enhances network resilience against attacks.

- Performance-oriented solutions, like block parallelization in Ethereum, are being explored to improve throughput.

Geographic Distribution of Blockchain Usage

- India leads global crypto adoption, maintaining its top position despite regulatory pressure.

- Indonesia recorded $157 billion in crypto inflows, even after banning its use as payment.

- North America accounted for approximately $1.3 trillion in on-chain value received from July 2023 to June 2024, about 22.5% of the global total.

- Growth in crypto use was especially strong in Sub-Saharan Africa, Latin America, and Eastern Europe, particularly in DeFi and stablecoin activity.

- Latin America received nearly $415 billion in cryptocurrency over 12 months, ranking just above Eastern Asia.

- Lower- and middle-income countries drove much of the recent adoption gains across multiple regions.

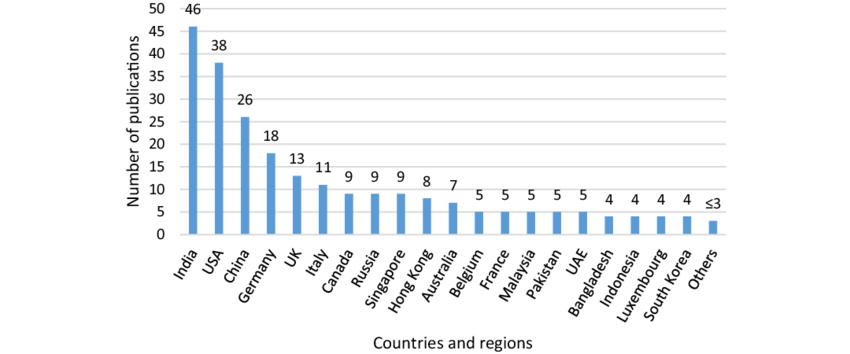

Global Research Publications by Country/Region

- India leads with 46 publications, making it the top contributor.

- The USA follows closely with 38 publications, holding the second position.

- China secures the third spot with 26 publications.

- Germany ranks fourth, contributing 18 publications.

- The UK comes next with 11 publications.

- Italy, Canada, and Russia each have 9 publications.

- Singapore and Hong Kong both account for 8 publications.

- Australia contributes 7 publications.

- Belgium, France, Malaysia, and Pakistan each produced 5 publications.

- UAE, Bangladesh, Indonesia, Luxembourg, and South Korea each recorded 4 publications.

- Contributions from other countries are minimal, each with ≤3 publications.

Gaming and Metaverse Market Statistics

- The global blockchain gaming market is estimated at $21.6 billion in 2025 and projected to rise to $1.27 trillion by 2033, a 63.4% CAGR.

- IMARC estimates the 2025 market at $24.4 billion, possibly reaching $1.17 trillion by 2033 with a 62.6% CAGR.

- In Q1 2025, metaverse-based NFT collections generated nearly $15 million across 32,824 sales, though this marked a 28% drop in volume and a 37% drop in sales vs. Q4 2024.

- North America’s blockchain gaming revenue reached $3.21 billion in 2024, with a forecast CAGR of 69.4% from 2025 to 2030.

- Within U.S. gaming, RPGs generated the most revenue in 2024, while collectible games posted the fastest growth.

Ethereum and Bitcoin Specific Statistics

- Ether ETFs received approval from the SEC, now permitting in-kind creations and redemptions, aligning with commodity ETF practices.

- Trump Media filed for a crypto ETF including Bitcoin, Ether, Solana, and Ripple.

- Post-Merge, Ethereum’s energy use dropped by 99.95%, and some estimates report over 99.99% reduction in carbon footprint.

- Bitcoin mining currently consumes about 169.7 TWh per year, exceeding Poland’s national electricity use, and emits carbon per transaction similar to a 1,600-2,600 km car drive.

- 52.4% of Bitcoin mining energy now comes from sustainable sources, with natural gas surpassing coal as the largest single energy source.

- Bitcoin accounts for approximately 0.78% of global electricity consumption.

- One Bitcoin mined uses more energy than 11,000 full Tesla charges. In the U.S., the electricity cost per Bitcoin mining now exceeds $100,000 in many regions.

Tokenization and Digital Assets

- Real-world asset (RWA) tokenization TVL reached $10.6 billion in April 2025, up from $4.4 billion a year earlier.

- By mid-2025, RWA TVL surged to $12.8 billion, a 65% increase year-to-date. Top protocols include Ondo Finance, Franklin Templeton, and MANTRA.

- Tokenized RWAs soared from $5 billion in 2022 to over $24 billion by June 2025, a 380% growth, making it crypto’s second fastest-growing sector after stablecoins.

- Tokenization enhances liquidity, on-chain collateral usage, and market access globally, especially for previously inaccessible assets like bonds or real estate.

Regulatory and Legal Statistics

- The SEC now allows in-kind creation/redemption for Bitcoin and Ether ETFs, aligning with standard commodity ETF rules.

- Coinbase is pursuing SEC approval to offer tokenized equities, expanding blockchain’s reach into regulated stock markets.

- The SEC issued guidance requiring clear, plain-English disclosures for crypto ETF applicants, emphasizing custody and risk clarity.

- Trump Media is actively seeking approval for a diversified crypto tokens ETF including BTC, ETH, SOL, and XRP.

Environmental Impact Metrics

- Ethereum’s Merge slashed its energy and carbon output by at least 99.95%, with some estimates approaching 99.99% reduction.

- Bitcoin mining remains energy-intensive, 169.7 TWh/year, surpassing the entire energy use of countries like Poland.

- Clean energy adoption in Bitcoin mining has reached 52.4%, with natural gas now replacing coal as the top energy source.

- Bitcoin consumes about 0.78% of global electricity, providing perspective on crypto’s broader environmental footprint.

- Mining one Bitcoin now uses enough power for 11,000 Tesla charges, with costs exceeding $100,000 in U.S. regions.

Conclusion

Blockchain continues to surprise with its expansive economic footprint and rapid innovation. From India’s leading global adoption and explosive growth in tokenized assets to seismic energy reductions in Ethereum and evolving regulatory frameworks, the ecosystem is maturing at a pace. Blockchain gaming is reshaping interactive entertainment, while real-world asset tokenization is forging entirely new financial plumbing. Challenges remain, particularly in Bitcoin’s energy use, but sustainability gains and regulatory clarity are closer than ever before.