Smartphones rely on core system apps to keep users connected, productive, and secure. Samsung’s pre-installed utilities, ranging from Galaxy Store to Knox, play a significant role across millions of devices. For instance, Galaxy Store now appears on over 250 million devices, fueling app distribution beyond Google Play. And Android, the platform most Samsung devices run, holds nearly 43% of the US mobile OS market, a strong base for system app exposure. Explore the full article to understand how these numbers shape user experience.

Editor’s Choice

- Android powers 71% of smartphones worldwide, with Samsung holding 23% of the Android vendor market.

- Galaxy Store is pre-installed on 250 million Samsung devices, offering a learner 15% developer revenue share.

- Upday has 25 million monthly users in Europe, making it a widely used news app across Samsung models.

- KCC flagged 187 pre-installed apps on Samsung models released between 2023 and 2024 in South Korea, under regulatory review.

- Android holds 42% market share in the US, key to how Samsung system apps propagate.

- Mobileusers access 9–10 apps daily and 30 apps monthly on average, suggesting even system apps see regular usage.

- There are 8.93 million mobile apps available globally, placing Samsung’s system apps among millions competing for usage.

Recent Developments

- The Galaxy AI suite, first in the Galaxy S24 launched in early 2024, now includes features like on-device translation, image editing, and smart routines, built into One UI 8 as of July 25, 2025.

- Knox 3.11, the latest security framework version, was released Feb 15, 2025, enhancing enterprise management and hardware-level protections.

- The KCC investigation in June 2025 into Samsung Studio and other apps shows mounting regulatory pressure on non-removable pre-installed software.

- Upday’s presence continues growing as a pre-installed news app across Galaxy devices in Europe, supported by its 25 million monthly user base.

- Samsung increasingly integrates AI into system apps, Galaxy AI functions now operate across multiple languages and include productivity tools like Now Brief and Now Bar.

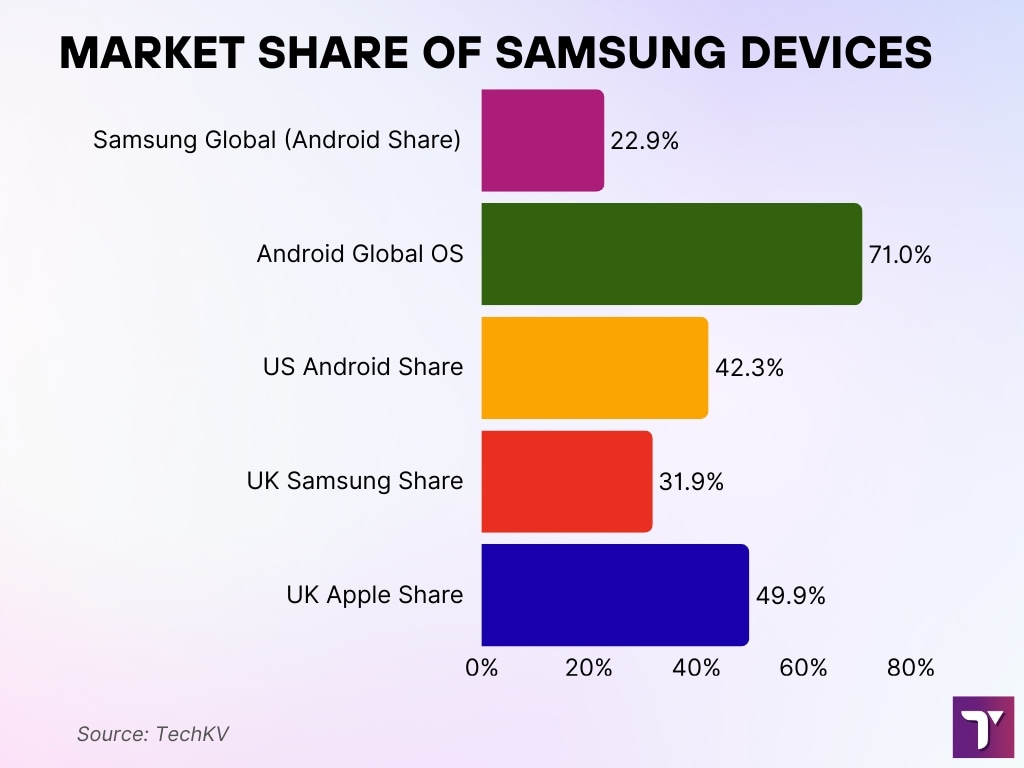

Market Share of Samsung Devices

- Samsung commands 22.9% of Android vendor share worldwide.

- With Android holding 71% of the global mobile OS market share, Samsung’s base reaches billions of users across software updates and apps.

- In the US, Android’s 42.3% market share further amplifies Samsung’s reach in its system app ecosystem.

- Strongholds in regions like India, Brazil, and Indonesia (Android >85%) mean system apps roll out widely in emerging markets.

- Recent UK data places Samsung second with 31.9% mobile phone share, trailing Apple’s 49.9%.

- Samsung’s global device volume, especially Galaxy S and A series, ensures system apps are widely distributed.

Number of Pre‑installed Samsung System Apps

- The KCC reviewed 187 apps pre-installed on Samsung phones between 2023, 2024 to assess user choice interference.

- The Galaxy Store offers a long list of Samsung apps (e.g., Samsung Internet, Samsung Health, Notes, Wallet, TV Plus) preloaded on devices.

- Upday is pre-installed across all Galaxy devices in Europe, boosting user exposure to system-level news services.

- Good Lock, a customizable UI suite, comes preloaded or strongly promoted, especially in markets where Samsung pushes UI flexibility.

- Knox arrives pre-installed on most Samsung devices, especially Galaxy business lineups, for enterprise-level security and management.

Download and Installation Statistics

- The Galaxy Store appears on 250 million Samsung devices as of 2025, serving as an alternative to Google Play.

- Galaxy Store data tools enable Samsung developers to track sales, downloads, in-app purchases, and user behavior.

- While Google Play offers 3.553 million apps, Samsung’s bundled system apps gain exposure through pre-installation, not installs.

- Globally, users download billions of apps annually (255B in 2023), but system apps bypass that metric by being built-in.

- App install patterns, 9 to 10 daily, 30 monthly, provide usage context even for system apps.

- Samsung’s Galaxy Store presence likely drives in-app update installs, though granular figures remain part of internal metrics.

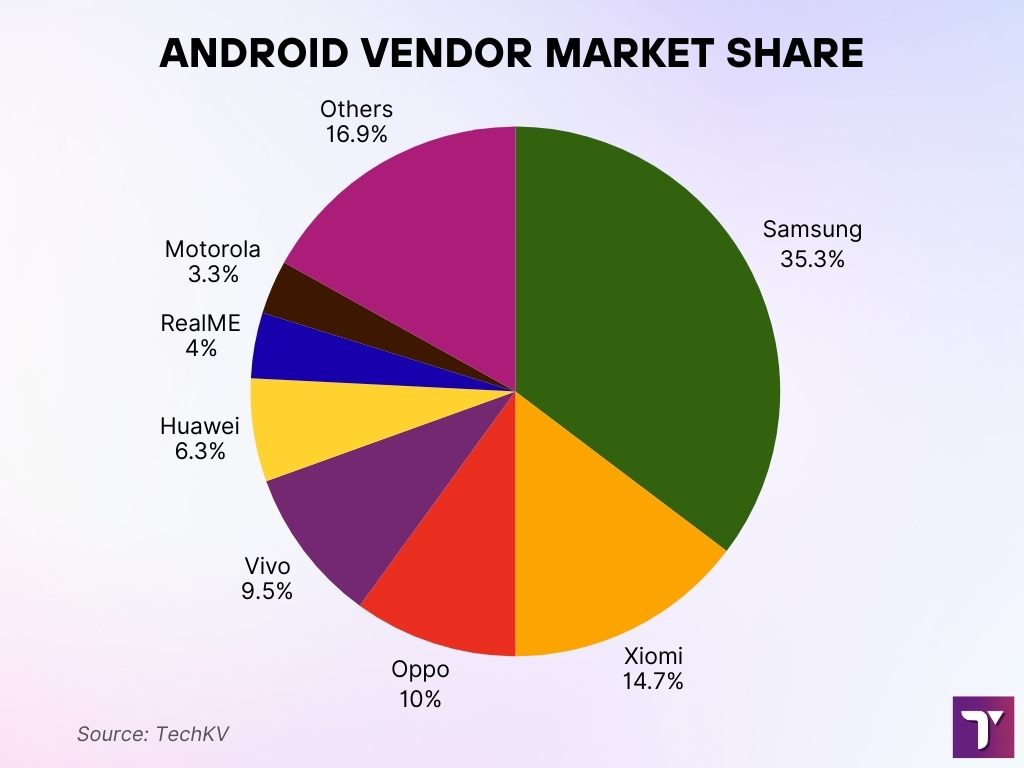

Android Vendor Market Share Insights

- Samsung dominates the Android market with a 35.3% share, making it the clear leader.

- Xiaomi holds 14.7%, securing the second position among Android vendors.

- Oppo contributes 10.0%, maintaining a strong presence in global Android markets.

- Vivo follows closely with 9.5%, showing consistent growth.

- Huawei accounts for 6.3%, reflecting its reduced but still significant global presence.

- RealME captures 4.0%, carving a niche in the affordable smartphone segment.

- Motorola represents 3.3%, maintaining a smaller but stable share.

- Other brands collectively make up 16.9%, highlighting a fragmented segment with many smaller players.

Usage Frequency of System Apps

- The average user accesses 9–10 apps daily and 30 apps monthly, suggesting built-in apps likely rank among frequently used apps.

- Upday’s 25 million monthly users indicate significant engagement with Samsung’s news utility in Europe.

- Apps like Samsung Health, Internet, or Notes, prevalent in Galaxy Store, are likely in frequent rotation due to their core utility.

- Knox’s enterprise use also implies frequent backend app access, even if not visible in consumer-facing metrics.

- Galaxy AI features such as Now Brief, Now Bar, and Bixby may be used daily for quick info and tasks, though usage stats are internal tools.

User Engagement & Monthly Active Users

- Upday maintains over 25 million monthly active users, making it one of the most engaged Samsung system apps in Europe.

- Android continues to support 3.3 billion global users in 2025, with Samsung accounting for 22.91% of Android vendor share.

- Given Android’s reach, Samsung’s system apps potentially engage hundreds of millions of users globally, even if specific MAU data remains internal.

- Galaxy AI features like Now Brief and Now Bar are embedded in One UI 8 and are likely to see daily interaction, though Samsung has not disclosed usage numbers.

- Enterprise-focused tools like Knox likely register high activity in business settings, even if consumer-facing metrics remain limited.

- Good Lock’s availability in over 40 countries since late 2023 indicates widespread personalization tool usage.

- With billions of Android users, even modest adoption percentages yield tens of millions of monthly users engaging Samsung system apps across regions.

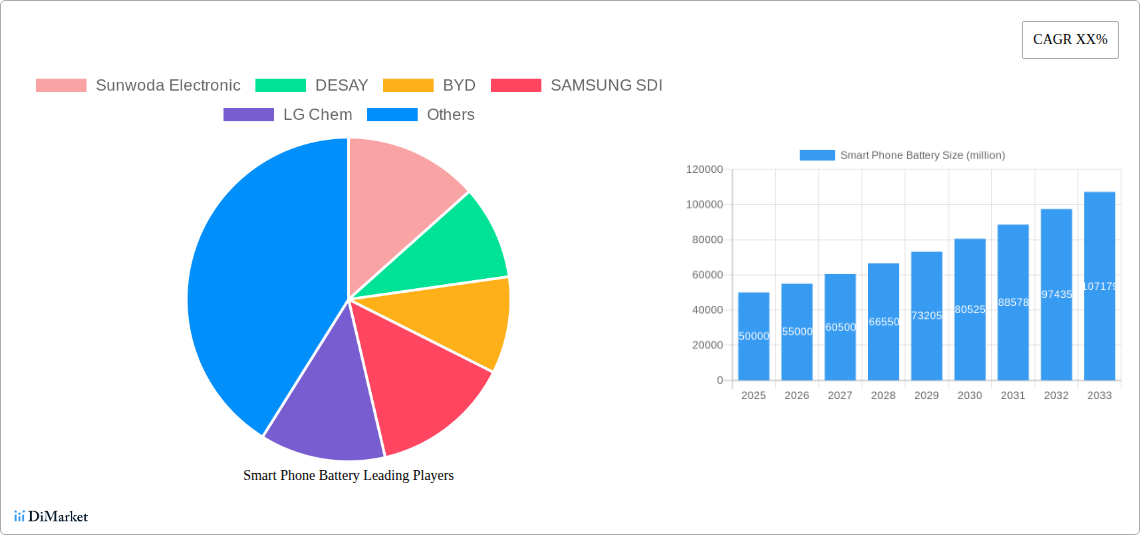

Smartphone Battery Market: Key Data Highlights

- The other category holds the largest market share in smartphone batteries, accounting for approximately 40% of the global share.

- Samsung SDI and LG Chem are major branded leaders, each with around 13%–14% share, signaling strong competition in premium battery supply.

- Sunwoda Electronic commands about 13% of the market, reflecting its rising influence in the OEM battery supply chain.

- DESAY and BYD each account for around 10% of the market, maintaining a steady foothold in both domestic and international battery production.

- The global smartphone battery market is projected to grow from 50 million units in 2025 to 107.18 million units by 2033.

- This represents a more than 2X increase in total battery volume over an 8-year span, showing accelerating demand from expanding smartphone shipments and longer battery life expectations.

App Launch Count Statistics

- As of 2025, users interact with 9 apps daily and 30 apps per month on average.

- Samsung’s system apps, like Internet, Health, Galaxy Store, and Notes, are likely part of the daily average.

- Approximately 47,000 Android apps launch monthly, underlining the constant churn users face. Built-in apps benefit from consistent visibility.

- Given 3.3 billion Android users, that translates to nearly 100 million app launches daily across the OS platform.

- System apps enjoy higher launch consistency compared to user-installed apps, which often are uninstalled or abandoned.

- Tools like Galaxy AI’s Writing Assist and Call Assist may see frequent use throughout the day in messaging or phone tasks.

- Enterprise utilities in Knox are likely launched during work hours, yielding structured usage bursts.

System App Update Statistics

- Samsung routinely updates system apps via the Galaxy Store and One UI updates, though exact update counts are proprietary.

- Galaxy AI’s expanded capabilities were introduced in One UI 8 (July 25, 2025), marking a major system app refresh.

- Good Lock received version 6.0 alongside One UI 6 in late 2023, showing continued iterative development.

- Samsung pushes monthly security patches that often include updates to core apps like Knox and Browser.

- The Device Care tool, pivotal for optimization, is updated with new power-saving features and maintenance schedules.

- Many Samsung system apps are updated via patch releases separate from full firmware upgrades, improving efficiency.

Foreground vs Background Usage Statistics

- Samsung’s Device Care tool shows foreground and background battery use per app, letting users optimize power consumption.

- Admin dashboards like Knox Asset Intelligence track average battery use by apps, including foreground vs background roles.

- On average, power-hungry apps in background or idle states are flagged by Device Care for user action.

- Apps like Bixby or AI assistants may run background services (e.g., voice detection), increasing idle usage.

- Samsung encourages placing rarely used apps in “Deep Sleep” to reduce background drain.

- Users who disable mobile data in low-signal areas effectively reduce background battery drain.

- Adaptive Battery and App Power Management automatically limit background use for infrequent apps.

App Screen Time Metrics

- Official screen-time data remains internal, but Galaxy’s Device Care tracks usage duration per app.

- Built-in utilities like Samsung Internet, Health, and Galaxy Store likely top the list due to convenience.

- Tools like Now Brief provide quick daily summaries, likely seen in short, frequent interactions.

- Customization apps like Good Lock attract longer engagement during setup phases.

- Enterprise tools like Knox may generate screen time in business workflows or security settings.

- As users install 80⁺ apps, system apps benefit from default visibility over many user-installed ones.

- Over time, persistent notifications or widgets from system apps may extend screen-time usage indirectly.

RAM Usage by System Apps

- Detailed RAM usage by individual system apps is not published, but Samsung optimizes them for performance.

- Background-heavy features like Galaxy AI’s Live Translate or Interpreter may temporarily consume more RAM during active use.

- Good Lock modules for customization load dynamically, using RAM only when active.

- Knox services operate as background daemons in enterprise environments, likely using consistent RAM shares.

- Samsung’s One UI architecture prioritizes efficient RAM handling by offloading idle services.

- Regular updates help reduce memory leaks, keeping RAM usage stable across system app iterations.

Battery Consumption Statistics

- Samsung’s Device Care offers live battery usage breakdowns by app, foreground vs background components.

- Enterprise dashboards can identify top battery-consuming apps across device fleets.

- In general, browser apps, like Samsung Internet, are known to be among the most battery-consuming when used heavily. Studies show ad blockers and dark mode can cut battery use by 20–40%.

- Samsung warns that a poor cell signal multiplies battery drain, and urges users to disable mobile data when not needed.

- Power modes (Optimized, Medium, Maximum) customize battery usage levels for system app behavior.

- Game Booster helps regulate performance and battery trade-offs during gaming, offering a dedicated Battery Saver mode.

- Overall, system apps are generally optimized for energy efficiency, with tools available for users to monitor and manage consumption effectively.

Data Usage Statistics

- Samsung users can track app-specific mobile and Wi‑Fi data usage via Settings, Network & Internet, Data Usage, showing real-time consumption by system apps.

- The tool logs all traffic, from streaming to messaging, making it possible to monitor how apps like Samsung Internet or Galaxy Store impact monthly data caps.

- Although Samsung does not publish system app data usage stats, similar in-built tools suggest system apps such as Galaxy AI features likely account for hundreds of megabytes weekly, especially when cloud-based tasks run.

- Android globally sends periodic background data even when idle. A 2022 study revealed that many devices transmit app-installed lists and other metadata automatically.

- In one analysis, 6 Android models continuously shared data with third parties, many including Samsung devices, without opt-out options.

- Limitations in user control persist despite Android’s enhanced data transparency, and these set the context for Samsung’s built-in data dashboards.

- Effective management of data usage remains vital, especially in regions where users rely on capped plans. Samsung’s dashboards and alerts assist in that effort.

Storage Space Used by System Apps

- Samsung doesn’t publicly state total storage taken by system apps, but tools like Device Care list individual app storage, suggesting system apps typically consume several hundred MB collectively.

- Galaxy AI features, Good Lock modules, Samsung Health, Internet, and others store local files, cache, and logs. Users can find app-specific details under Settings, Apps.

- Pre-installed apps benefit from system-level exemptions, though they often still occupy reserved storage that increases with updates.

- Over time, cumulative updates inflate the footprint, especially for system apps with offline AI features or persistent background services.

- Samsung’s Auto‑clear cache or Device Care suggestions help manage residual storage automatically.

- Analytics from Galaxy Store via Samsung’s developer portal (Galaxy Store Statistics) enables publishers (and by extension, Samsung) to monitor app size evolution per version.

- While absolute figures remain proprietary, the trend leans toward leaner system apps to preserve user space and avoid bloat.

Privacy and Data Sharing Metrics

- Under Samsung’s Data Privacy Framework, third-party partners processing personal data must commit to strict privacy standards and notify Samsung if they cannot comply.

- Samsung maintains liability for third-party mishandling of data unless it’s conclusively proven otherwise under the framework.

- The company collects only what’s relevant and retains data only as long as needed for its purpose, reinforcing data integrity and purpose limitation.

- Users can access, correct, or request deletion of their personal data via defined mechanisms under Samsung’s privacy frameworks.

- Despite these policies, independent studies reveal that many Android apps, across brands including Samsung, share data with third parties, including metadata, behavioral tracking, and app lists, without clear disclosure.

- A broader mobile study found 17% of apps claim not to collect personal data, yet still transmit it, misleading millions globally.

- Samsung offers the Privacy Dashboard (available from One UI 4/Android 12 onward), enabling users to view recent app permissions, such as location or camera access, in the past 24 hours.

User Ratings and Reviews Statistics

- Samsung does not release aggregated user rating data for system apps, though ratings appear within Galaxy Store listings.

- External feedback from forums frequently cites user concerns, particularly about battery drains post‑update, which often correlate with system app behaviour.

- Users report issues such as rapid battery drop after software updates (e.g., One UI 7), signaling system apps as possible contributors.

- Samsung’s transparent Permission Manager and Privacy Dashboard empower users to rate and restrict apps, although direct system-app review channels remain limited.

- On fan forums, users voice frustrations like: “Battery drain after the update… device dies faster.”

- Public feedback often drives Samsung’s performance fixes in subsequent patches.

System App Performance Trends

- Android telemetry indicates that operating system versions and updates can affect system app performance, particularly battery and memory footprints.

- One UI 7 rollout (beginning April 2025) increased support and performance tuning across mid‑range and flagship devices.

- Galaxy AI suite on-device processing reduces latency and reliance on the cloud, enhancing responsiveness for key features like Live Translate and Now Brief.

- Updates like Knox 3.11 (February 15, 2025) signal performance refinements for security and enterprise apps.

- Samsung continues optimizing RAM and storage usage by modularizing apps (e.g., Good Lock modules load only when needed).

- Device Care and Game Booster tools show evolving management of performance and energy through app profiling.

- Firmware-level tweaks and use of ARM TrustZone in Knox demonstrate investments in performance without compromising safety.

Comparative App Statistics (Samsung vs Other Brands)

- One academic study found that many Android brands, Samsung among them, collect and share data by default, even at idle, with no opt-out.

- Other OEMs also embed pre-installed utility apps. Samsung treads a middle path by offering removal or disabling options for many system apps via Package Disabler or Settings.

- Samsung’s Galaxy AI and Knox platforms offer more advanced on-device security and AI compared to other OEM offerings.

- In terms of software support, Samsung now leads with 7 years of OS/security updates for flagship models, and 6 years for select mid-range devices, surpassing many rivals.

- Samsung’s combination of enterprise-grade security (Knox), personalization (Good Lock), and AI features positions it ahead of brands offering fewer built-in utilities.

- Privacy controls like the Privacy Dashboard give Samsung an edge in transparency compared to others slower to adopt such dashboards.

Conclusion

Samsung’s system apps stand at the intersection of usability, privacy, and performance optimization. From data dashboards to enterprise-grade security, the company continues building services into its ecosystem that reach hundreds of millions globally. While battery, storage, and data usage concerns surface periodically, especially after updates, tools like Device Care, Privacy Dashboard, and structured app modularity empower users to manage impact. With extended software support, a robust AI suite, and strong privacy frameworks, Samsung shapes a service-rich experience. As Android evolves, these system apps will remain critical to user experience and device longevity, inviting digital creators and users alike to stay informed and adaptable.