Smartwatches now sit at the intersection of fashion, health, and connectivity. Adoption continues rising as consumers expect smarter, more responsive devices on their wrists. In enterprise settings, insurers use smartwatch data to adjust premiums, while clinicians monitor patients remotely using watch‑based vitals. Let’s dive into the latest numbers and trends driving this dynamic sector.

Editor’s Choice

- 34.8 million units shipped globally in Q1 2025, representing a 4.8% year-over-year growth.

- The global smartwatch market is forecast to grow from $42.5 billion in 2025 toward $92 billion by 2034.

- Approximately 15% of older people (aged 65+) now use smartwatches.

- In the U.S. and Canada, about 32% of respondents report using a wearable device (including smartwatches) as of 2024.

- The broader wearable technology market was estimated at $84.2 billion in 2024.

- From 2025 to 2029, the smartwatch segment alone is projected to grow by $46.3 billion, at a CAGR of ~15.5%.

- Innovations like generative AI, enhanced connectivity, and on‑device activity recognition are emerging as major trend drivers.

Recent Developments

- TAG Heuer launched its Connected Calibre E5, replacing Wear OS with a proprietary OS that still supports iPhones.

- Google introduced the Pixel Watch 4, which features a 3,000-nit display, extended battery life to 42 hours, and tighter Fitbit/Google Health integration.

- Nothing released the CMF Watch 3 Pro, boasting 13-day battery life, dual‑band GPS, and support for 131 sports modes.

- A university study found PFAS “forever chemicals” in many popular smartwatch bands, raising concerns over skin exposure.

- In India, shipments dropped 28.4% YoY in Q2 2025, reflecting market saturation in entry‑level models.

- Apple Watch sales reportedly fell 19% in 2024, though it remains a dominant brand.

- The WatchHAR system was introduced, enabling on‑device real-time activity classification (over 25 activity types, <12 ms latency).

- A smartwatch-based model estimated bite weight during eating with an average error of ~3.99 g, presenting new dietary monitoring potential.

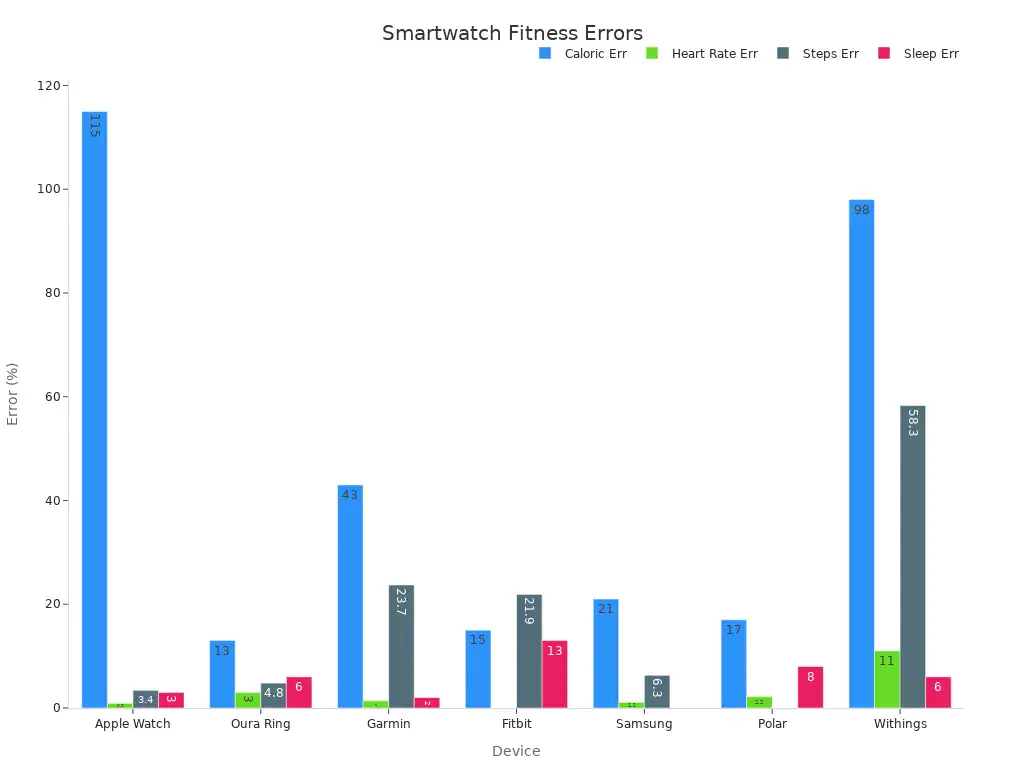

Smartwatch Fitness Tracking Accuracy Comparison

- Apple Watch showed the highest calorie error at 115%, but maintained low heart rate (3.4%), steps (3%), and sleep (3%) error rates.

- Withings recorded the worst step error at 58.3% and the second-highest calorie error at 98%, indicating major measurement inaccuracies.

- Garmin had a 43% calorie error and 23.7% step error, though its heart rate and sleep errors were minimal.

- Samsung posted a 21% calorie error, 6.3% step error, and a very low heart rate error of 1.3%, suggesting strong consistency in vitals tracking.

- Fitbit showed a 15% calorie error, 21.9% step error, and a notable 13% sleep error, marking an inconsistency in sleep tracking.

- Polar maintained 17% calorie and 8% sleep error, but achieved nearly zero error in steps and heart rate, reflecting strong overall accuracy.

- Oura Ring demonstrated excellent overall accuracy, especially in sleep and heart rate tracking, outperforming several smartwatch brands in consistency.

Global Smartwatch Market Overview

- The global smartwatch market is estimated at $39.1 billion in 2024 and is expected to grow significantly.

- Some forecasts place the market value at $60.56 billion in 2024, with $76.17 billion forecast for 2025.

- Another study estimates the market at $37.19 billion in 2025, rising to $67.98 billion by 2032.

- Market segmentation (beyond just smartwatches) shows wearable market value at $109.34 billion in 2023, heading toward $303.98 billion by 2029.

- In 2024, wearables in North America represented over 34% of revenue in the wearables space.

- Wrist-wear (smartwatches + wristbands) accounted for over 58% of wearables revenue in 2024.

- IDC reports that global smartwatch shipments are projected to grow by ~2.5% in 2025.

- According to IDC, the U.S. market is relatively flat, expecting 0.9% shipment growth in 2025 as users upgrade older watches.

- Technavio forecasts $46.3 billion incremental growth in the smartwatch sector between 2025 and 2029.

Smartwatch User Demographics

- Globally, 23% of men own a smartwatch vs. 21.8% of women.

- Among internet users aged 25–34, women slightly outpace men in smartwatch ownership.

- Among age brackets:

• 16–24 years: 19.6% female, 21.0% male.

• 25–34 years: 27.2% female, 26.9% male.

• 35–44 years: 24.5% female, 25.5% male.

• 45–54 years: 18.6% female, 20.9% male.

• 55–64 years: 12.7% female, 16.1% male. - Around 15% adoption among people 65+.

- Some reports state 35% of users are male, while 15% are 55+ in age distribution estimates.

- In the United States and Canada, 32% of people report using a wearable device.

- In the broader wearable market, the wrist-wear segment claims over 58% of revenue.

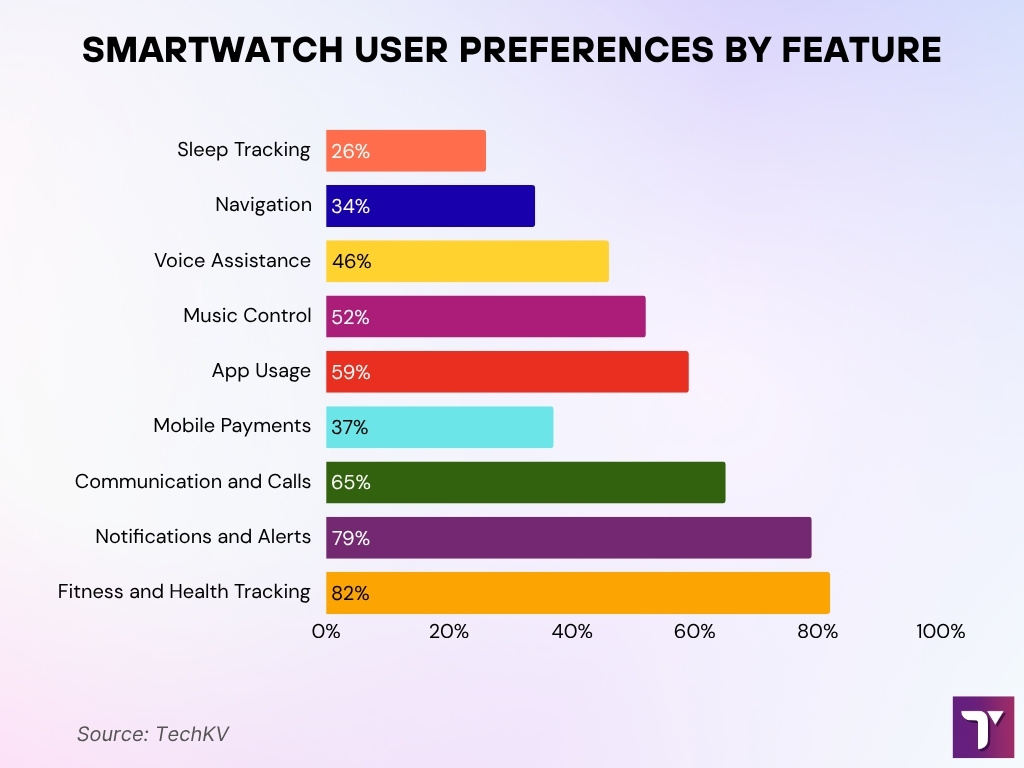

Smartwatch Features Ranked by User Preference

- 82% of users prioritize Fitness and Health Tracking, confirming it as the most in-demand feature.

- 79% value Notifications and Alerts, underscoring the need for instant updates on the wrist.

- 65% use smartwatches for Communication and Calls, highlighting their expanded utility beyond fitness.

- 59% engage in App Usage, signaling a rising appetite for multifunctional apps.

- 52% utilize Music Control, reflecting how smartwatches enhance media convenience.

- 46% rely on Voice Assistance, showing growing comfort with AI-driven interaction.

- 37% perform Mobile Payments, indicating moderate adoption of smart payment options.

- 34% use Navigation features, showing increasing reliance on location support.

- 26% track Sleep, making it the least-used feature, though still key for health-conscious users.

Market Segmentation

- By product: smartwatches, wristbands, earwear, others. In 2023, earwear held over 51% of the revenue share in wearables.

- By application: healthcare & medical is among the leading segments in wearables revenue.

- By region: Asia-Pacific leads in growth, often exceeding 20% CAGR.

- North America holds ~32% share in wearables as of 2023.

- Smartwatch forecasts by application show growth in wellness, sports, and medical monitoring.

- Based on the operating system, segments include watchOS (Apple), Wear OS / Android, Tizen, RTOS, and others.

- By form, there are “extension” (companion to phone) vs “standalone” (cellular-enabled) device types.

- Some segmentation models note that the male-targeted segment held $18 billion share, growing toward $41 billion by 2035.

Smartwatch Sales and Shipments

- In Q1 2025, global smartwatch shipments reached 34.8 million units, marking a 4.8% YoY rise.

- However, Counterpoint reports that the global smartwatch market declined 7% in 2024, the first-ever annual contraction.

- IDC expects smartwatch shipments to grow 2.5% in 2025.

- In the U.S., IDC forecasts 0.9% shipment growth as users begin replacing older devices.

- According to TechInsights, growth rebounded with +1% in Q1 2025 and +4.5% in Q2 2025, following four quarters of contraction.

- In 2024, wearables overall shipments declined ~1%, but forecasts for 2025 call for a 2.4% rebound.

- The mid-price segment ($100–200) expanded 21% in shipments, while sub‑$100 devices shrank 17%.

- Regional markets show uneven recovery, and China shipments jumped 25.3% in Q1 2025.

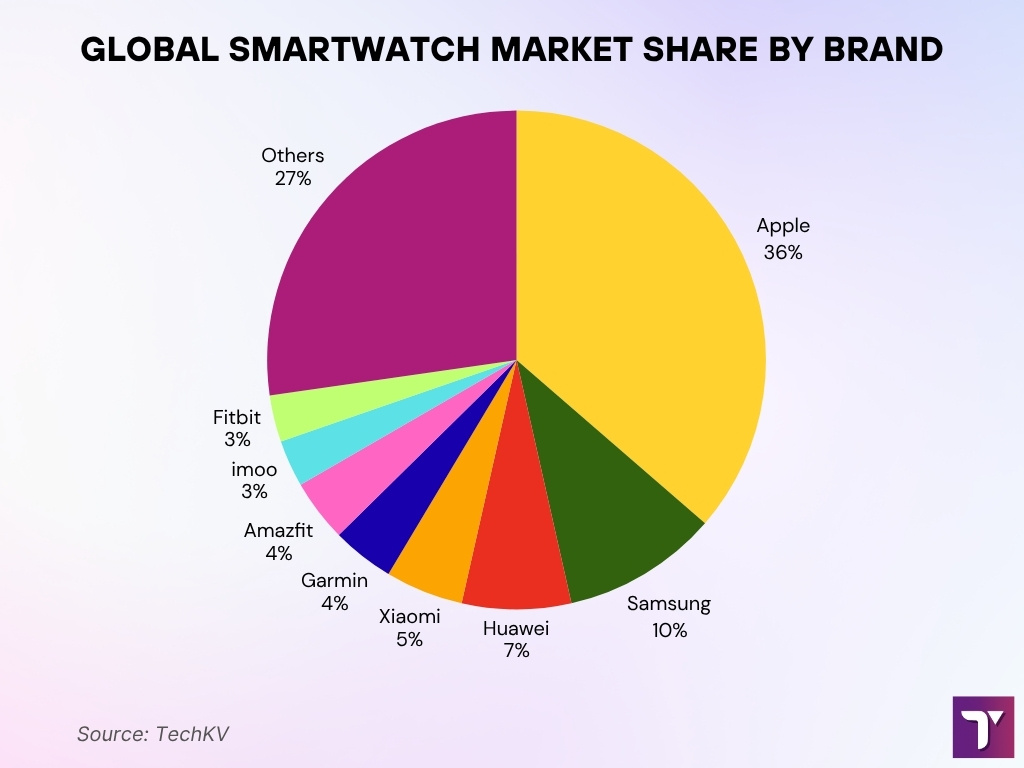

Global Smartwatch Market Share by Leading Brands

- Apple leads the global smartwatch market with a 36% share, reinforcing its dominance and brand loyalty.

- Samsung ranks second with a 10% share, showing strong competition in the premium Android segment.

- Huawei holds 7%, maintaining steady growth across both domestic and global markets.

- Xiaomi captures 5%, continuing to appeal to budget-conscious consumers.

- Garmin and Amazfit each command 4%, thriving in the fitness and health-focused segment.

- imoo and Fitbit follow with 3% each, targeting niche and wellness-oriented audiences.

- Other brands collectively account for 27%, reflecting a highly fragmented and competitive market.

Regional Smartwatch Market Insights

- Asia-Pacific leads in sales, accounting for ~40% of global smartwatch volume.

- North America holds over 34% of wearable revenues, wrist‑wear is the largest category (~58%) in 2024.

- In India, Q2 2025 shipments fell 28.4% YoY, signaling saturation in entry‑level segments.

- China’s demand recovery saw domestic vendors (Huawei, Xiaomi) drive strong growth.

- Latin America saw ~24% growth in early 2025 in some markets.

- Europe shows more moderate growth, and replacement cycles lengthen as consumers delay upgrades.

- Online channels dominate, ~58% of smartwatch sales globally occur via e‑commerce.

- Emerging markets (e.g., in Asia, Latin America) saw shipment growth of ~35% over recent years vs ~20% in mature markets.

Health and Fitness Tracking with Smartwatches

- Fitness‑oriented smartwatches represent ~42% of all shipments in recent years.

- 92% of users state they use smartwatches for fitness and health tracking.

- 56% of Gen Z and 46% of millennials actively track heart rate and sleep via wearable devices.

- On-device human activity recognition (WatchHAR) achieves > 90% accuracy across 25+ classes with < 12 ms latency.

- Smartwatches estimated bite weight during eating with a mean absolute error of 3.99 g.

- 65% of users say they use the device for calling and communication beyond fitness.

- 82% prioritize fitness/health features, 79% use real-time notifications.

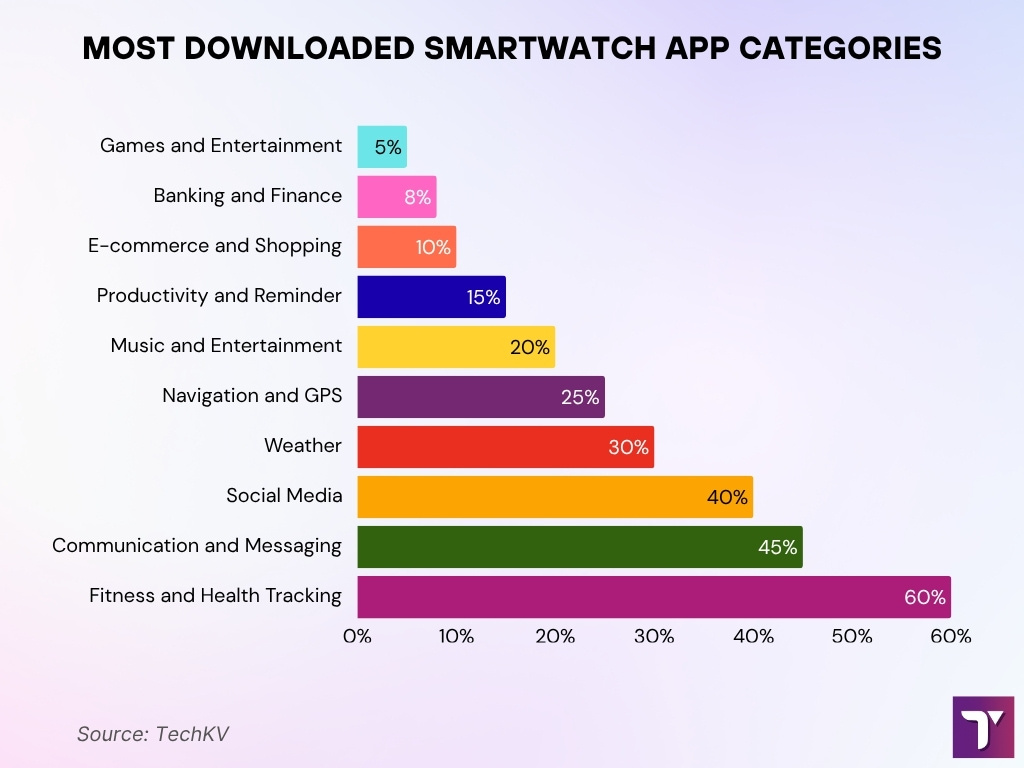

Most Popular Smartwatch App Categories by Downloads

- 60% of users downloaded Fitness and Health Tracking apps, making it the most downloaded category.

- 45% prefer Communication and Messaging apps, valuing hands-free interaction.

- 40% have Social Media apps, showing strong engagement with online platforms.

- 30% rely on Weather apps for instant climate and forecast updates.

- 25% use Navigation and GPS apps, reflecting their importance in travel and location tracking.

- 20% downloaded Music and Entertainment apps, emphasizing audio streaming and media control.

- 15% favor Productivity and Reminder apps to organize tasks and daily schedules.

- 10% use E-commerce and Shopping apps, showing emerging retail adoption on wearables.

- 8% installed Banking and Finance apps, indicating limited but growing trust in wearable payments.

- 5% downloaded Games and Entertainment apps, making it the least used category.

Consumer Preferences and Buying Behavior

- 83% of consumers rate health monitoring as a top priority when choosing a smartwatch.

- 60% of buyers consider battery life one of the most critical features.

- Interchangeable (customizable) strap designs are among the top demanded features.

- In the U.S., 22%–26% of adults now own a smartwatch.

- The U.S. market is projected to grow at ~22% annual rate, driven by feature upgrades and IoT integration.

- Demand for IoT-integrated smartwatches is said to be growing 5× compared to earlier years.

- Nearly 50% of U.S. internet households own and use wearable devices.

- Among smartwatch users, 92% use devices for health or fitness tracking.

- 58% of smartwatch sales happen via e‑commerce channels.

Usage by Application

- 82% of users prioritize fitness and health tracking as the primary application.

- 79% use notifications and alerts (calls, messages) as a core function.

- 65% make calls or use communication via their smartwatch.

- 59% engage with apps on the watch itself.

- 52% control music playback from their watch.

- 46% use voice assistance/voice commands on their watch.

- 37% conduct mobile payments (NFC / wallet) via smartwatch.

- 34% use navigation/map directions features on the wrist.

- Some research indicates activity recognition (e.g., WatchHAR) runs fully on‑device with > 90% accuracy across 25+ classes.

IoT Integration and Connectivity

- The global IoT market is projected to cross $1.06 trillion by 2025.

- In that same timeframe, more than 18 billion IoT devices are expected to be connected globally.

- Key 2025 IoT trends influencing wearables, AI integration, edge computing, 5G, security, and blockchain.

- Edge computing reduces latency by processing data locally instead of relying solely on the cloud.

- On‑device AI / ML models are becoming feasible in smartwatches (e.g., WatchHAR).

- Wearables are adopting smart textiles, low-power chipsets, and efficient connectivity (BLE, 5G).

- Security and privacy become central with more devices collecting sensitive health data.

- The shift from sensor-based to video‑based IoT data is anticipated in health, environment, and agriculture.

- Federated learning and blockchain techniques are being explored to secure wearable IoT networks and preserve data privacy.

Emerging Trends and Innovations in Smartwatches

- Luxury and niche brands are moving away from standard OS platforms (e.g., TAG Heuer using proprietary OS).

- Hybrid and fashion-first smartwatches are more common, blending aesthetics with smart features.

- On‑device activity recognition (e.g., WatchHAR) promises privacy, speed, and reduced cloud dependence.

- Smartwatch features are expanding into thermal sensing, respiratory monitoring, glucose estimation, and environmental alerts.

- Just-in-Time Adaptive Interventions (JITAI) use context + watch data to nudge user behavior (e.g., noise, heat responses).

- Modular designs, repairability, and sustainable materials are gaining attention.

- The wearables-to-smart fashion transition is accelerating (smart fabrics, integrated sensors).

- Security threats, studies show ultrasonic covert communication using smartwatch microphones (SmartAttack).

- As users age, font sizes, glanceability, and UI design need adaptation, disparities emerge in the 75+ age group.

Frequently Asked Questions (FAQs)

There are about 454.69 million smartwatch users worldwide in 2025.

34.8 million units were shipped globally in Q1 2025, a 4.8 % YoY increase.

The market is expected to reach $42.5 billion in 2025, with an estimated CAGR of 15.5 % toward 2034.

WatchHAR achieves > 90% accuracy across 25+ activity classes with a latency of ~11.8 ms.

Conclusion

Smartwatches will continue evolving beyond fitness gadgets into full-fledged health platforms, IoT nodes, and fashion accessories. The market grows steadily, though with signs of saturation in entry tiers, yet the real momentum lies in AI, edge computing, and advanced sensing capabilities. Consumer preferences now center on health features, long battery life, and secure connectivity. As adoption climbs into the hundreds of millions globally, innovation that balances privacy, usability, and battery constraints will define the winners. Dive into the full article to explore each trend, segment, and statistic in detail.