Video-calling apps have become indispensable tools in both work and daily life. Millions use them to join team meetings or connect with family across borders. For example, healthcare providers rely on video calls for remote consultations, while schools use platforms like Zoom for virtual classrooms. As demand continues to climb, this article dives into the latest numbers and what they mean for users and businesses alike.

Editor’s Choice

- Paid video conferencing subscriptions have more than doubled since 2020, now reaching 89 million globally.

- Zoom holds ~56% of the global video-conferencing market share in 2025.

- Enterprises with over 1,000 employees spend $242,000 per year on video-conferencing tools.

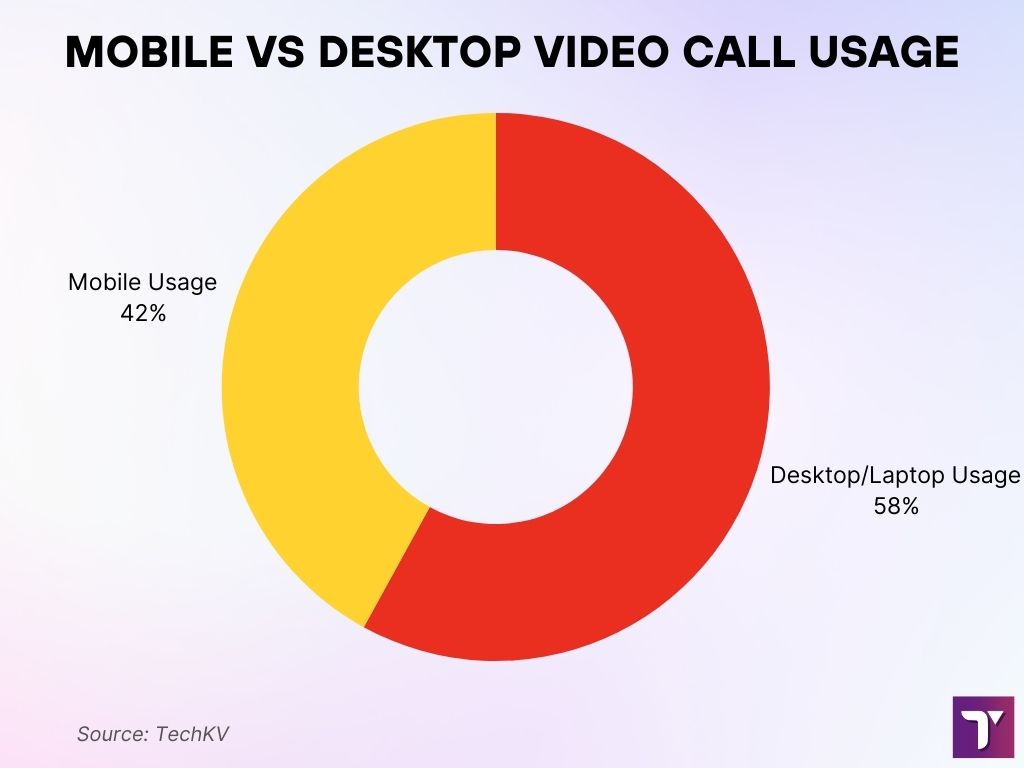

- Mobile accounts for 42% of video-conferencing sessions, with 58% on desktop or laptop.

- The average user attends 5.4 calls weekly, up from 3.8 two years ago.

- The global video-conferencing market is valued at $28.6 billion in 2025, projected to grow further.

- Asia-Pacific saw the highest regional growth in users (~34%), compared to 21% in Europe and 18% in North America.

Recent Developments

- Skype was officially retired in May 2025 as Microsoft transitions users to Teams.

- In 2024, the video-conferencing market grew from $4.9B to $5.1B.

- Platforms are embed AI, virtual assistants, and hybrid-workspace integration have become key trends in recent years.

- Cloud-based solutions now represent 73% of the video-conferencing market, while on-premise systems hold 27%.

Global Video Call Apps Usage Statistics

- 89% of remote workers use video-conferencing tools at least once a week.

- Mobile makes up 42% of total sessions, desktop/laptop 58%.

- The average user attends 5.4 calls weekly, up from 3.8 two years ago.

- Users aged 18–34 prefer video over phone calls (78%), while only 49% of users over 50 feel the same.

- Latin America saw a 29% increase in adoption last year, vs 18% in Europe and 15% in North America.

- 54% of first-time users joined a video call for personal reasons, not work.

- 41% used video calls for family events like birthdays or reunions.

- In enterprises with >500 employees, the average is 11.6 calls per employee per week, vs just 2.3 among personal users.

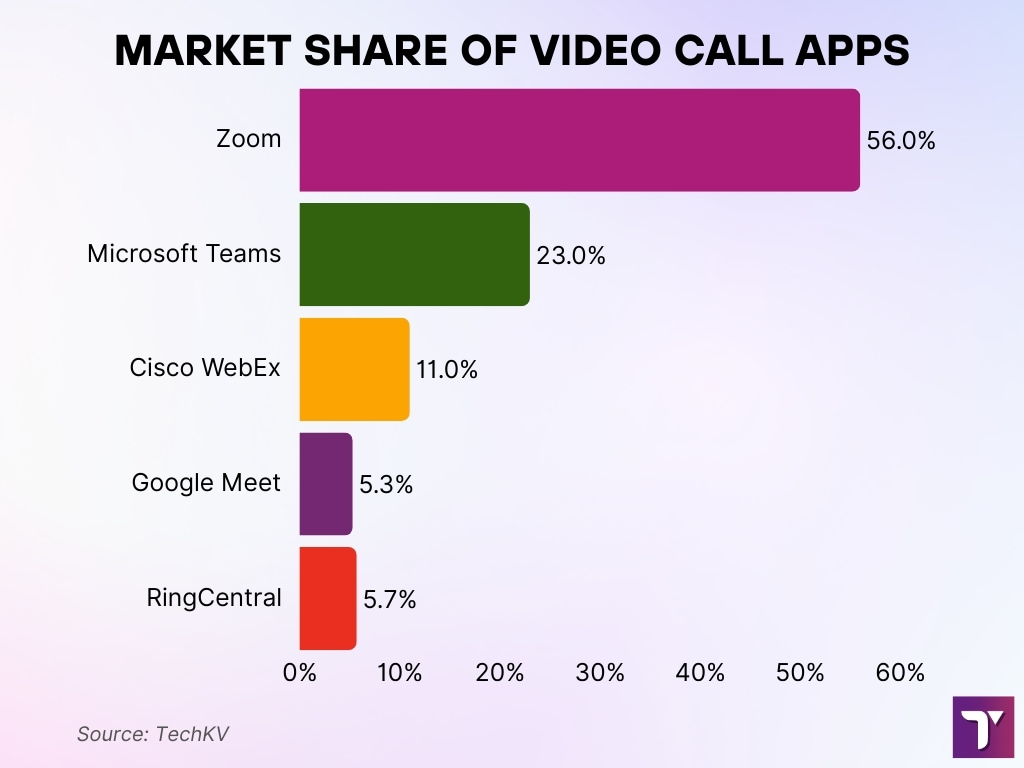

Market Share of Video Call Apps

- Zoom commands ~56% of the global video-conferencing market share in 2025.

- Microsoft Teams holds 23% of the market in 2025.

- Cisco WebEx accounts for 11%.

- Google Meet holds around 5.3%, while RingCentral has about 5.7%.

- Earlier data (2022) showed Zoom at ~55.4%, Teams at ~20.9%, and GoToMeeting at ~12.8%.

Most Popular Video Call Platforms by Country

- Microsoft Teams is the leading video-conferencing tool in 41 countries in 2025, and Zoom leads in 7.

- With Skype retired in May 2025, users are migrating to Teams, Zoom, Google Meet, and WebEx as alternatives.

- In regions like Latin America, adoption of video apps increased by 29%, outpacing Europe (18%) and North America (15%).

Growth Trends in Video Calling

- Paid subscriptions more than doubled since 2020, to 89 million in 2025.

- Asia-Pacific grew fastest at 34% YoY, followed by Europe (21%) and North America (18%).

- The overall market size reached $28.6B in 2025, with continued upward momentum.

- Enterprises with over 1,000 staff now spend $242,000 annually on video-conferencing solutions.

- Cloud-based tools (73%) are rapidly overtaking traditional on-premise systems (27%).

- The number of Zoom daily active users surpassed 300 million, reflecting sustained adoption growth.

- The global video conferencing market grew from $4.9B to $5.1B between 2023 and 2024.

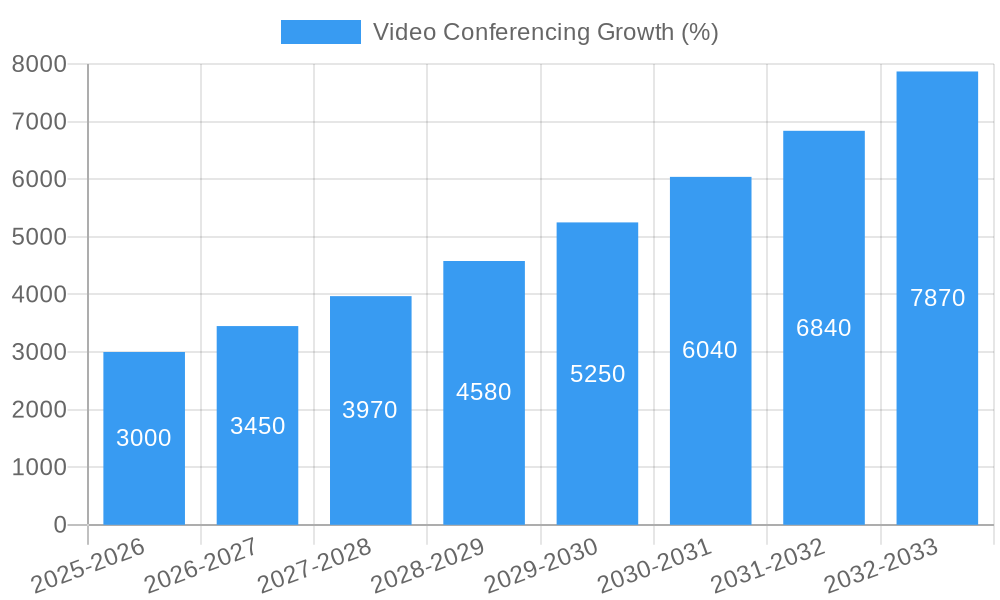

Video Conferencing Growth Forecast

- In 2025–2026, the video conferencing market is projected to reach 3,000 units (growth measure).

- By 2026–2027, the market is expected to expand to 3,450 units, marking a steady upward trend.

- In 2027–2028, growth continues, climbing to 3,970 units.

- By 2028–2029, the market will rise further to 4,580 units, showing consistent adoption.

- In 2029–2030, the market size crosses the 5,250 units mark, reflecting strong acceleration.

- By 2030–2031, the industry is expected to grow to 6,040 units, highlighting robust long-term demand.

- In 2031–2032, the forecast jumps to 6,840 units, reinforcing the sector’s expansion trajectory.

- By 2032–2033, the market is projected to peak at 7,870 units, more than doubling from 2025–2026 levels.

Demographic Breakdown of Video Call App Users

- 25–34-year-olds make up the largest share of Zoom’s user base at ~29.7%, followed by 35–44-year-olds at 21.5%.

- Zoom’s user base is almost evenly split by gender, 50.1% female, 49.9% male.

- U.S., Japan, India, Canada, and the UK account for over 50% of Zoom’s revenue and user base.

- 72% of users have joined a video meeting from a smartphone at least once, indicating strong mobile engagement.

- Asia-based users average 6.1 video calls per week, compared to 4.9 in Europe and 4.4 in North America.

- Business users tend to prefer desktop platforms (72%), whereas personal users lean toward mobile apps (46%).

- 41% of users participate in video calls for family events, highlighting social as well as professional use cases.

Frequency of Video Calls per User

- Companies with over 500 employees report an average of 11.6 video calls per employee per week, personal users average only 2.3.

- Zoom users attend 6.7 meetings per week on average, compared to 4.9 for Teams and 4.2 for Google Meet.

- 65% of users join at least one video call every weekday.

- 42% of users have joined a video call lasting longer than one hour in the past month.

- Users aged 18–24 spend about 5.6 hours per week on video calls, compared to 3.2 hours for users aged 45 and older.

- Teams with over 50 members average 4.8 video calls per day, whereas small teams (fewer than 10) have about 2.1 per day.

- 28% of meetings end early, on average, 7 minutes before the scheduled end time.

Mobile vs Desktop Video Call Usage

- 58% of video meetings occur on desktops/laptops, 42% are on mobile devices.

- 72% of users have used mobile to access at least one Zoom meeting.

- Business users show a strong preference for desktop (72%), while personal users typically use mobile (46%).

- 41% use video conferencing for personal social events like family gatherings or reunions.

- Business calls are more likely to include features like virtual backgrounds and integration with scheduling tools, indicating optimized desktop-based workflows.

- Tablet usage for video conferencing rose 12% YoY in 2024, driven by education demand.

- 56% of global Zoom users accessed at least one meeting through mobile in 2024.

- North America shows stronger desktop use (66%), while Asia-Pacific skews toward mobile (49%).

- College students report 84% mobile preference for group study calls.

Impact of Video Calling on Business Communication

- 89% of people use Zoom for work purposes, while 63% also use it for personal conversations.

- 36% of users report feeling more productive in video meetings compared to audio-only calls.

- 83% of organizations use video conferencing for internal communication, while only 29% of personal users use it more than once a week.

- Business users are 2.5 times more likely to integrate scheduling tools (like Calendly or Google Calendar) with their video platforms than personal users.

- COVID-aged remote work trends show video platforms have become core infrastructure for hybrid and distributed teams.

- Business leaders say video tools helped sustain productivity during hybrid transitions.

- UCaaS (Unified Communications as a Service) is consolidating tools; 75% of companies aim to reduce the number of apps they use for more efficient communication.

Video Call Apps for Education and Remote Learning

- 76% of U.S. K-12 schools used Zoom, Meet, or Teams at least once weekly in 2024.

- EDUCAUSE reports 88% of higher ed faculty incorporated video conferencing into coursework in 2024.

- 56% of students in U.S. universities attended at least one fully online class in 2024.

- UNESCO notes that over 220 million learners globally engaged in digital or video-based education in 2024.

- Parents of school-aged children (71%) in the U.S. reported managing video learning sessions weekly.

- The average U.S. student spends 5.6 hours weekly on video learning platforms.

- Faculty report a 49% increase in virtual office hour attendance since implementing video tools.

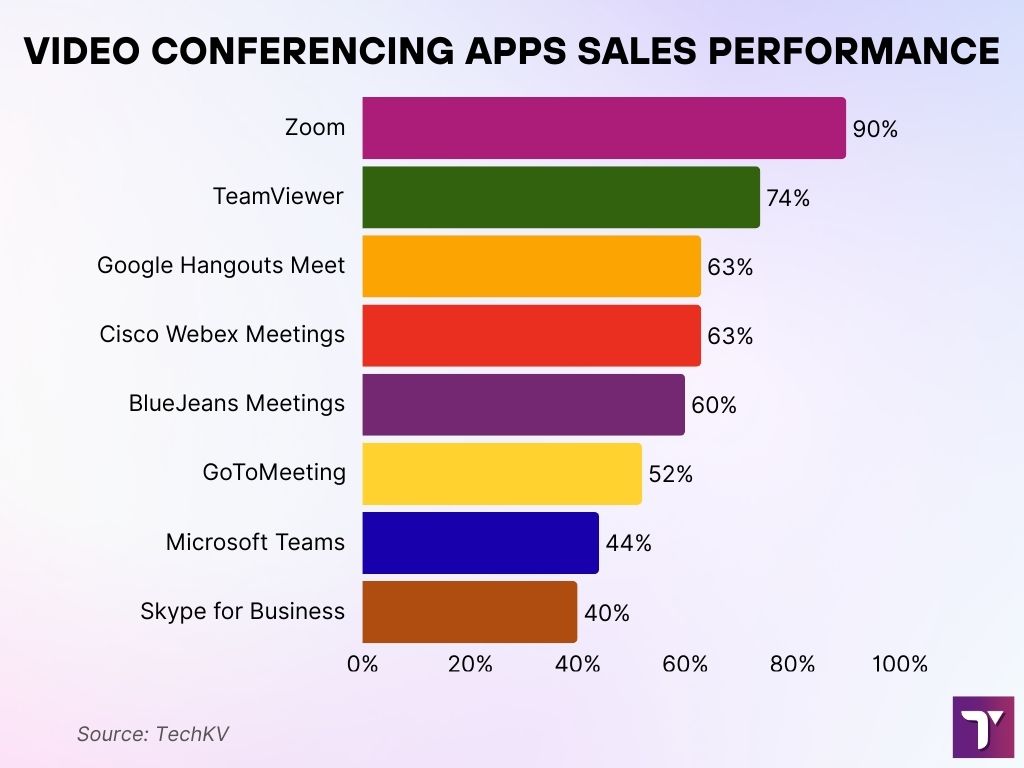

Video Conferencing Apps Sales Performance

- Zoom leads the market with a 90% sales performance score, showing the highest customer satisfaction and adoption.

- TeamViewer follows with a strong 74%, highlighting its reliability in remote access and video conferencing.

- Google Hangouts Meet achieves a 63% performance score, on par with Cisco Webex Meetings at 63%, reflecting steady enterprise adoption.

- BlueJeans Meetings secures a 60% rating, positioning itself as a mid-tier but trusted platform.

- GoToMeeting registers 52%, slightly above average in meeting user expectations.

- Microsoft Teams records 44%, placing it below average despite its widespread use, suggesting gaps in user satisfaction.

- Skype for Business comes last with only 40%, indicating a sharp decline in competitiveness compared to newer tools.

User Satisfaction and Experience with Video Call Apps

- 87% of Zoom users rated the platform as “satisfactory” or better in 2024.

- Microsoft Teams holds a 4.3/5 satisfaction rating on G2Crowd, with reliability cited as the top factor.

- 61% of professionals say fatigue from video calls impacts their satisfaction with platforms.

- Among students, 73% rated video learning positively, though 41% noted issues with connectivity.

- 49% of users said breakout rooms and collaboration features enhance the experience significantly.

- Enterprises switching providers cite “ease of integration” (54%) as the biggest satisfaction factor.

- Security transparency boosts satisfaction 78% of users say clear communication about data practices improves trust.

Security and Privacy Statistics for Video Call Apps

- Zoom received 6,580 government data requests globally in 2024, up 21% from 2023.

- Microsoft Teams reported 9,220 law-enforcement requests in 2024, with 62% involving U.S. authorities.

- Google Meet faced 4,100 user data requests in 2024.

- End-to-end encryption adoption in major apps rose to 67% in 2024, compared with 39% in 2021.

- 34% of enterprises listed data privacy as their top concern in selecting a video platform.

- Zoom expanded its bug bounty payouts by 41% in 2024 to improve security resilience.

- 53% of U.S. professionals worry about video calls being recorded without consent.

- 28% of organizations adopted zero-trust frameworks to secure video calls in 2024.

Video Call Apps Revenue and Market Value

- The global video conferencing market reached $13.07 billion in 2025, up from roughly $11.65 billion in 2024. It’s projected to grow toward $24.46 billion by 2033, reflecting a CAGR of 8.2%.

- Another outlook estimates the market size at $37.29 billion in 2025, with growth to $60.17 billion by 2032 at a CAGR of 7.1%.

- In 2024, revenue was around $14.2 billion, with business platforms contributing 61%, and North America leading with $5.9 billion, followed by Europe at $3.1 billion.

- The U.S. video conferencing market alone is expected to surpass $9 billion by the end of 2025.

- The enterprise segment is forecasted to grow from $6.35 billion in 2021 to $10.10 billion in 2025, representing a CAGR of 12.3%.

- North America captures about 39%, Europe 28%, Asia-Pacific 21%, South America 5.5%, and the Middle East and Africa combined around 6% of enterprise video conferencing revenue.

App Features Adoption Rates (e.g., recording, screen sharing)

Reliable global adoption data specifically for video-call features remains limited in available sources. To deliver accurate statistics, I recommend targeted research, perhaps via vendor reports or industry studies, to capture feature usage rates like screen sharing, recording, or AI-powered tools.

Statistics by Industry (Healthcare, Finance, etc.)

Similarly, precise numbers detailing adoption by industry, such as healthcare telemedicine statistics or finance sector data, aren’t accessible in the current search results.

Regional Variations in Video Call App Usage

- North America leads video conferencing revenue, followed by Europe and Asia-Pacific.

- Within the enterprise segment, North America holds ~39%, Europe 28%, and Asia-Pacific 21% of revenue share.

- The U.S. market alone is set to hit $9 billion by the end of 2025.

Video Call App Retention and Churn Rates

- Across software products, 39% of users remain after one month, with only 30% still active after three months.

- For general mobile apps, the three-month retention average is 29%, meaning 71% churn over that period.

- In 2024, Zoom reported historic low monthly churn rates and growing numbers of large enterprise accounts, signaling strong customer retention.

Future Projections for Video Call Apps

- Forecasts anticipate industry expansion to $24.46 billion by 2033 (CAGR 8.2%) and $60.17 billion by 2032 (CAGR 7.1%), depending on the source.

- Enterprise video conferencing is projected to climb to $25.54 billion by 2033 (CAGR of 12.3%).

- The broader trend across 2025-2034 forecasts an 8.4% CAGR in web conferencing technologies, underlining continued demand and innovation.

Comparison of Top Video Call Apps (Zoom, Teams, Meet, Skype, etc.)

- As of 2025, Zoom holds about 55.91% of the global market share, while Google Meet stands at 5.52%.

- Microsoft Teams has approximately 280 million daily active users, while Zoom logs around 300 million. Market share estimates put Teams near 32.29% in 2025.

- Microsoft Teams is deeply integrated with Microsoft 365, making it ideal for internal collaboration. Zoom offers broader third-party integration (over 1,000 apps), suiting external meetings and webinars.

- In May 2025, Skype was officially shut down after 23 years, with users encouraged to transition to Teams, Zoom, Meet, or WebEx.

Conclusion

The video call industry stands at a crossroads of mainstream adoption and ongoing innovation. Market value ranges between $13 billion and $37 billion, depending on scope, with forecasts pointing well beyond the $60 billion mark in the next decade. Enterprise usage continues to escalate faster than consumer uptake, supported by investments in AI features, advanced integrations, and hybrid communication frameworks.

Zoom leads globally, though Teams remains a powerhouse within Microsoft’s ecosystem. With Skype now discontinued, the landscape is consolidating around platforms that combine robust functionality with seamless user experiences.

As organizations and individuals embrace hybrid workflows, the future of video communication appears expansive, data-driven, and adaptive, ready to evolve with emerging technologies and shifting needs.