The metaverse is evolving from sci-fi to a growing digital economy where millions connect, play, shop, and learn in virtual spaces. Real-world applications include virtual concerts, such as those held in Roblox, and workplace simulations that train employees in immersive scenarios. These examples show tangible progress. Explore the full article to discover the latest data on adoption, revenue, and tech.

Editor’s Choice

- The global metaverse market is projected to $203.7 billion in 2025, up from $130.5 billion in 2024, reflecting a CAGR of 44.4 %.

- Another source estimates the market could reach $507.8 billion in 2025, with a 37.4 % CAGR.

- Approximately 700 million monthly active users engage in metaverse platforms in 2025.

- A lower-bound estimate lists over 600 million active users globally.

- Gaming in the metaverse accounts for a massive $183 billion of the economy in 2025.

- Education-related tools and virtual campuses drive $21 billion in metaverse revenue.

- Over 65 % of Gen Z and Millennials in the U.S. report engaging weekly with metaverse platforms in 2025.

Recent Developments

- Roblox’s daily active users jumped 41 % year-over-year in Q2 2025, to 111.8 million.

- In Q1 2025, Roblox hit 97.8 million daily active users, up 26 % from a year earlier.

- Roblox’s bookings soared to $1.44 billion in Q2, up from $955 million previously.

- The company raised its full-year bookings forecast to $5.87–$5.97 billion, signaling 36 % growth.

- Metaverse brand integrations surged, on Roblox, brand campaigns grew by 110–124 % in 2023, especially via pop-up experiences.

- In these campaigns, nearly 50 % of Roblox’s DAU are Gen Z, about 34 million users.

- Developers earned over $740 million on Roblox in 2023 through popular titles and in-world items.

Global Market Size and Revenue Growth

- Metaverse revenue jumped from $65.2 billion in 2022 to $94.1 billion in 2023, then $130.5 billion in 2024, and is forecasted $203.7 billion in 2025.

- One projection estimates the metaverse market could hit $507.8 billion in 2025, suggesting even more robust growth.

- Gaming alone makes up $183 billion, and education $21 billion in the 2025 economy.

- North America leads with 38 % of metaverse users, while Asia-Pacific grows fastest at 41 % YoY.

- Europe’s user base rose 28 % in 2025, with Germany and the UK leading.

- Latin America adoption climbed by 19 %, boosted by mobile-first platforms and entertainment content.

User Base and Active Users

- 700 million monthly active users across top metaverse platforms in 2025.

- Alternatively, another estimate lists 600 million active users, with 51 % under age 13 and over 83 % under 18.

- Over 400 million users already engage with metaverse platforms monthly as of 2024.

- Roblox alone contributed 111.8 million daily users in Q2 2025.

- Q1 2025 daily active users on Roblox reached 97.8 million, up 26 % YoY.

- A significant portion of these users are Gen Z; half of U.S. users under 16 are on Roblox.

- Brand interest by youth remains high, with over 65 % of Gen Z and Millennials engaging weekly in 2025.

Demographics of Users

- Over 65 % of U.S. Gen Z and Millennials engage weekly with metaverse platforms.

- On Roblox, half of all American children under 16 use the platform monthly.

- Among active metaverse users globally, 51 % are under 13, and 83.5 % under 18.

- Gen Z makes up approximately 50 % of Roblox’s daily users, around 34 million.

- The sharp concentration of younger users underscores the youth-driven nature of metaverse engagement.

Market Segments (Hardware, Software, Services)

- Precise breakdown data for the 2025 segment spending, hardware, software, and services is limited from available sources.

- However, platforms like Roblox illustrate strong software/service performance through high user activity and record bookings ($1.44 billion in Q2, up from $955 million).

- Brand integrations and developer revenue (e.g., $740 million in creator earnings) suggest service and in-world commerce are key growth areas.

- Hardware investment is implied by adoption in markets like Asia-Pacific, growing 41 %, but direct data on device spending isn’t available in the current search results.

Geographic Distribution of Market

- North America continues to lead with 38% of global metaverse users in 2025.

- Asia-Pacific shows the fastest growth at 41% year-over-year, with India, Indonesia, and Vietnam emerging as hotspots where user bases have doubled in the past year.

- In Europe, user adoption grew by 28%, with the UK and Germany at the forefront.

- Latin America saw adoption rise 19%, largely driven by mobile-first platforms and entertainment content.

- The U.S. metaverse market held the largest regional share at 42.8% in 2024.

- Software accounted for a 41.6% revenue share in North America in 2024.

- Desktop platforms dominated globally in 2024, followed by VR/AR technologies on key growth trajectories.

Platform Popularity and Usage

- Roblox reported 85.3 million daily active users by February 2025, comprising half of all American children under 16.

- Gaming platforms remain the most popular use of the metaverse, with three-fourths of gaming revenue from platforms like Roblox and Fortnite tied to digital in-game purchases.

- Brand integrations, especially pop-up experiences, are rising, with names like L’Oréal, Adidas, and Maybelline leveraging Roblox for immersive marketing campaigns.

- Development tools and social features on platforms like Horizon Worlds support user-created worlds and social hubs, even though active users on Horizon have declined.

Technology Adoption (VR, AR, XR)

- Software remains the dominant segment in metaverse revenue, with VR and AR technologies at the forefront of platform growth.

- Significant investments in cloud-edge infrastructure, 5G, and advanced optics are accelerating VR/AR adoption.

- Reports project $325 billion in metaverse market opportunities by 2030 for vendors specializing in infrastructure, devices, software, and services.

- XR technologies, like haptics and eye-tracking, are expanding beyond entertainment into areas like education, healthcare, urban planning, and professional training, though ethical and privacy challenges persist.

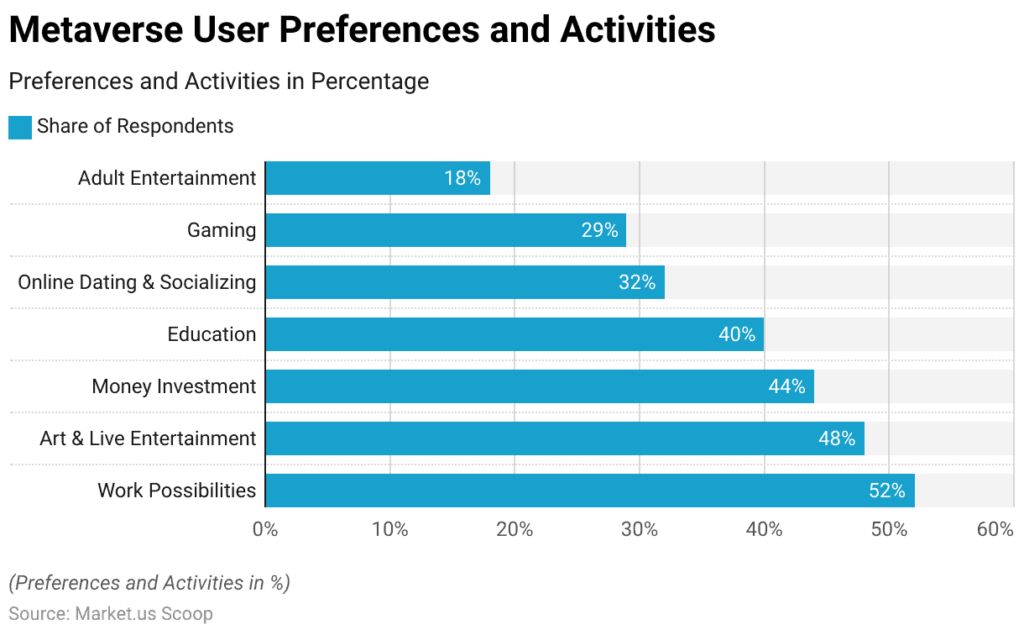

User Behavior and Engagement

- As of mid-2025, the metaverse hosts approximately 700 million monthly active users.

- 25% of consumers are projected to spend at least one hour per day in the metaverse by 2026, for purposes ranging from work to entertainment.

- 52% of users worldwide express a strong interest in joining the metaverse for work-related opportunities.

- Among U.S. adults, 26% have used the metaverse in the past year, rising to 80% among VR headset owners.

Industry Investments and Spending

- The software segment held a 41.6% share of the metaverse market revenue in 2024, highlighting its dominance.

- Investments in devices, infrastructure, and platform services are expected to reach a substantial $325 billion by 2030.

- Regional market leadership from North America, coupled with fast expansion in Asia-Pacific, indicates robust investment patterns across both mature and emerging markets.

Applications by Sector (Gaming, Entertainment, Education, Work)

- Gaming remains the backbone of the metaverse economy, contributing $183 billion in revenue in 2025.

- Education is a rising sector, with the metaverse generating $21 billion in educational revenues.

- Work and productivity tools within virtual environments are gaining traction, with 52% of global users citing work-related use as a key motivator.

- Brands such as L’Oréal and Adidas entering platforms like Roblox signal a growing crossover between retail, entertainment, and virtual experiences.

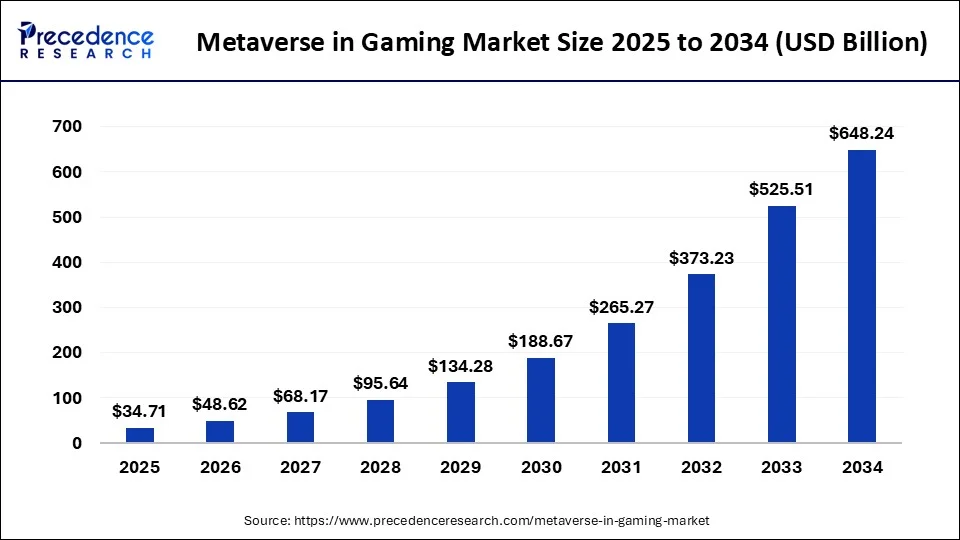

Metaverse in the Gaming Market Growth

- The Metaverse in the Gaming market is projected to expand rapidly over the next decade.

- In 2025, the market size is estimated at $34.71 billion.

- By 2026, it is expected to rise to $48.62 billion, showing strong early growth.

- The market will surpass $95.64 billion by 2028, almost tripling within three years.

- In 2029, projections indicate a value of $134.28 billion, marking a significant acceleration.

- The market will nearly double to $265.27 billion by 2031, highlighting exponential adoption.

- By 2032, it is forecast to reach $373.23 billion, crossing the $300 billion mark.

- A sharp jump is expected in 2033, with the market growing to $525.51 billion.

- The industry is projected to peak at $648.24 billion in 2034, nearly 19x growth from 2025.

Social and Cultural Impact

- The metaverse is very much youth-driven, with 45% of users aged 10–25, followed by 34% Millennials, and 43% of users identified as female.

- Urban residents are three times more likely to use metaverse services daily than rural users.

- The average user age in 2025 is 28.7 years, underlining a relatively young, engaged user base.

- English and Mandarin remain the most commonly used languages in metaverse interfaces.

- Platforms are evolving from play to expression, used for political activism, social hangouts, and creative expression.

- Despite opportunities, privacy, moderation, and safety concerns remain high; for example, one investigation found that 33% of users met in Horizon Worlds appeared to be under 13, raising significant child protection issues.

Economic Impact and Market Value

- As of Q2 2025, the total metaverse market cap stands at $552 billion. Notably, financial services account for $76 billion, or 13.8% of that value; tokenized real estate alone exceeds $112 billion.

- Some forecasts value the global metaverse market at $146.6 billion in 2024, with expectations to grow to $1.1 trillion by 2030 at a 39.3% CAGR.

- Another reputable projection puts the 2025 market size at $316.3 billion, ramping up to $1.33 trillion by 2029 (CAGR ~43.3%).

- Yet a different perspective estimates $1.27 trillion for 2025, soaring to a staggering $7.64 trillion by 2032 (CAGR ~29.2%).

- Overall, metaverse markets range from hundreds of billions to multi-trillion-dollar territory, depending on the scope, financial services, hardware, real estate, e-commerce, and more.

- Comparatively, the market remains dynamic and fragmented, showcasing both unrealized potential and speculative variance across forecasts.

Awareness and Familiarity

- In early 2022, 69% of U.S. adults had heard of the metaverse, but only 38% were at least somewhat familiar, with just 14% very familiar.

- A survey echoes this: 45% of Americans are not familiar with the metaverse at all, and only 9% are very familiar.

- One study shows a significant “awareness–activity gap”; 48% say they “know nothing about the metaverse”, yet 68% had taken part in metaverse-related activities (e.g., using Roblox, Decentraland, Fortnite).

- Among Gen Z, that activity participation rises to 88%, with 53% feeling more comfortable in the metaverse than in real life.

- Data support that older generations have lower familiarity; only 1 in 5 Americans over 55 say they understand the concept.

User Preferences and Activities

- Gen Z and Millennials are the top demographic in metaverse activity and familiarity; half of platform users are under 16, especially on Roblox.

- A majority believe the metaverse could replace social media; one study found 66% of those familiar think so.

- Key activities include gaming, social hangouts, brand interactions, education, and work-related use, with 52% expressing interest in using it professionally.

- Financial services such as NFT loans, virtual banking, and tokenized assets are rising, $6.5 billion in NFT-backed lending alone.

- Tokenized real estate already exceeds $112 billion, indicating a strong appetite for digital ownership.

Leading Companies and Competitors

- Meta’s Reality Labs division has lost over $60 billion since 2020, with a $4.2 billion loss in just one recent quarter, prompting layoffs and strategic backpedaling.

- Market leaders vary across segments, hardware (Meta’s Quest), gaming (Roblox), real estate (Decentraland), finance (DeFi platforms), and infrastructure (AI, AR/VR vendors).

- In China, giants like Baidu, Tencent, Bytedance, and Netease are investing heavily in e-commerce, virtual events, and fashion metaverse applications. China’s metaverse could scale to $457 billion by 2030.

Challenges and Concerns

- Privacy and user safety remain top concerns; studies show developers lack sufficient strategies to manage sensitive data in the metaverse.

- Meta’s VR platforms, particularly Horizon Worlds, face scrutiny, having failed to gain traction, compounded by rising costs and low Quest headset sales.

- Broad public skepticism persists; only 16% of Americans can correctly define the metaverse, and many remain uncertain or uninterested.

- Security issues, harassment, and accessibility also remain serious obstacles, with a documented lack of protective frameworks in virtual spaces.

Future Growth Projections and Forecasts

- Forecasts span $316 billion (2025) to $1.27 trillion (2025) and even $7.6 trillion by 2032, reflecting highly varied assumptions on adoption, tech, and monetization.

- Some analysts foresee $1.1 trillion by 2030 at a 39.3% CAGR, capturing markets in work, gaming, health, education, and finance.

- Investments in AR/VR market infrastructure alone are expected to exceed $250–300 billion in the near term.

- Regionally, North America currently dominates, while Asia-Pacific, especially China, promises the fastest-paced growth through public-private synergies.

Conclusion

The metaverse remains one of the most compelling and contentious technological frontiers. Market projections range from tens of billions to trillions, reflecting uncertainty in adoption, infrastructure, and business models. Platforms like Roblox show strong traction, especially among younger users, while financial and real estate services are rapidly expanding. However, the path to broader acceptance is weighed down by privacy risks, high hardware costs, low public familiarity, and mixed confidence from major players like Meta. Still, with global investments surging and regional ecosystems strengthening, the metaverse is far from dead; it’s evolving. As we move deeper into this hybrid digital-physical era, the next few years will determine whether the metaverse becomes ubiquitous or just a footnote in digital history.